Lesson 15: Follow The Rules For Picking Stocks

This interview originally appeared in Investor's Business Daily on October 15, 2001

In this lesson, William J. O'Neil discusses how to evaluate a stock thoroughly before making a purchase. He has numerous rules for selecting stocks. These rules come solely from studying extensive models of all successful companies every year since 1953.

Q: What are the most important rules for picking stocks?

O'Neil: Sixty percent of my method is devoted to fundamental analysis, because I want to buy only really great companies that have unique new products or superior services. I'm looking for the true market leaders, companies that are No. 1 in their particular field, companies that are superior to their competition or have little true competition. Once you determine that you are operating in an uptrending general market, here are the factors you should consider:

Are the company's current quarterly earnings per share up at least 25%? Are the percentage increases in profit accelerating compared with recent quarters? Does it have six to 12 quarters of significant earnings increases - up 50%, 100%, even 200% or more? Is the next quarter's consensus earnings estimate up a worthwhile amount? Have earnings in the past few quarters been higher than expected? If it's a growth stock, is each of the last three years of earnings up an average of 25% or more per year? Is the company's Earnings Per Share Rating 80 or higher?

If it's a turnaround stock, does it have two quarters of strong earnings increases or one quarter that is up so much that the 12-month earnings per share are back to their old peak? If two or more quarters have turned up, are the trailing 12-month earnings near or above the peak of the prior couple of years? How much are the consensus earnings estimates up for the next two years?

Does the company have six to 12 quarters of strong sales growth? And has that growth rate accelerated in recent quarters?

Is the current quarter's after-tax profit margin at or close to its peak? Has there been a general trend of profit-margin improvement over many quarters? Are the company's margins among the best in its industry?

Is the annual pretax profit margin 18% or more? (It's OK if retailers have lower margins.)

Is the return on equity 20% to 50% or more, and is its ROE among the very best in its industry?

Is its Sales + Profit Margins + ROE Rating an A or B? That would place it among the top 40% of all stocks in terms of sales growth, pretax and after-tax profit margins, and return on equity.

Does the company's management own the stock?

Is the stock in a quality price range? Quality comes at $16 to $150 for Nasdaq stocks and $20 and above for NYSE stocks. Remember, real leaders like Cisco Systems, Wal- Mart and Microsoft broke out of their beginning chart bases several years ago between $30 and $50 per share - before they had giant price advances. Price is a basic reflection of quality.

Is the stock part of a historically winning industry group such as retail, computers and technology, drug and health care, or leisure and entertainment? Is it in one of the top five groups now? Check the 52-Week Highs & Lows feature (New Highs list) on the Industry Groups page.

Do Investor's Business Daily's small index charts in the Mutual Funds section show that the market favors big-cap or small-cap stocks? Don't fight market trends.

What broad economic sector is the market favoring? Consumer or high tech? Growth or cyclical (stocks that move up and down with the business cycle), or defensive (food, utilities and other things everyone uses all the time)?

Does the company's product save money, solve a problem or save time? Or is it a new drug or medical technique? Is it widely needed or liked? Is it a product that encourages repeat sales?

Is the company's backlog of unfilled orders expanding? At what percent of capacity is the company operating? What is the company's expected rate of future expansion?

Have one or two of the smarter, better-performing mutual funds bought the stock recently? This is an indirect, fundamental cross-check because the better institutions will have done extensive research before buying.

Do you really understand and believe in the company's business? Have you seen or used its product or service? The more you know about your company, the more conviction you'll have.

Now that you're dealing with a truly superior company, the remaining 40% is technical and timing analysis. You need both - not just one or the other.

CANSLIM & Momentum Investing 01 (May 08 - Jul 09)

Re: CANSLIM & Momentum Investing

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: CANSLIM & Momentum Investing

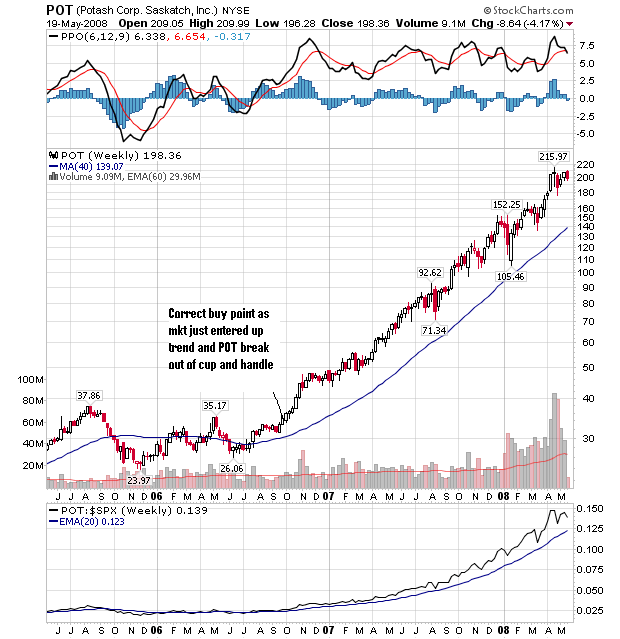

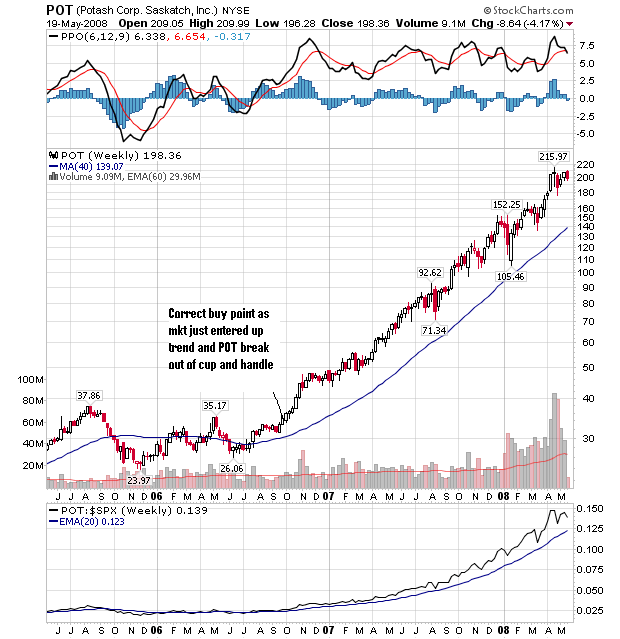

Just found a stock that is SUPER SWEE to showcase a former leader's breakout, RUN UP.. and BREAKDOWN...

The stock is POT - Potash... belonging to the once mighty hot chemical/fertilizer group..The group was in the top of the industry group charts for almost 2 years.

Here is the breakout and run up back in 2006

The top and the breakdown...

The stock is POT - Potash... belonging to the once mighty hot chemical/fertilizer group..The group was in the top of the industry group charts for almost 2 years.

Here is the breakout and run up back in 2006

The top and the breakdown...

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: CANSLIM & Momentum Investing

mm : thanks for this chart....

i have always struggled to concisely detect a valid cup-and-handle pattern. since u chose POT, it is timely for my query within the picture. hope you can teach me or point out why my choice of entry point is incorrect. thanks.

i have always struggled to concisely detect a valid cup-and-handle pattern. since u chose POT, it is timely for my query within the picture. hope you can teach me or point out why my choice of entry point is incorrect. thanks.

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: CANSLIM & Momentum Investing

K,

Classical TA.

35.17 (around May 06)..... won't there be a resistant at 37.86?

Breaking 37.86 would probably also signal a 52 week high, possible?

Classical TA.

35.17 (around May 06)..... won't there be a resistant at 37.86?

Breaking 37.86 would probably also signal a 52 week high, possible?

1. Always wait for the setup. NO SETUP; NO TRADE

2. The trend will END but I don't know WHEN.

TA and Options stuffs on InvestIdeas:

The Ichimoku Thread | Option Strategies Thread | Japanese Candlesticks Thread

2. The trend will END but I don't know WHEN.

TA and Options stuffs on InvestIdeas:

The Ichimoku Thread | Option Strategies Thread | Japanese Candlesticks Thread

-

iam802 - Big Boss

- Posts: 5940

- Joined: Wed May 07, 2008 1:14 am

Re: CANSLIM & Momentum Investing

K,

Simple answer - May - Aug 2006 - MKT WAS IN CORRECTION

Hope this helps.

Cheers,

mm

Simple answer - May - Aug 2006 - MKT WAS IN CORRECTION

Hope this helps.

Cheers,

mm

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: CANSLIM & Momentum Investing

802 :

2 parts in my response to your post above...

#1 ) one single point, usually does not form a resistance, however, it is a challenge nevertheless...more of a psychological barrier becos, u see, i see, tom sees, mary sees, and the whole world sees that as well...at the slightest sign of weakness rallying to that 37.86, you dump, i dump, tom dumps, mary dumps and the whole world dumps.. resulting in what seems to be a resistance point.

#2) if my suggested entry point @35.17 has the above concern, so does MM's choice of entry point in Oct, which is also about the same price as 35.17 if not even lower.

my original question is and remains, why is the May HIGH Volume/ Up Price not a valid entry point. as far as i can see, that entry point possesses about all that cup-handle formation describes.

You see, in hindsight, I can always justify ANY and ALL TA tools. however, this is not useful to me.

The test of usefulness of any TA tool is marked by its consistency in its predefined parameters being accurate in forecasting a price action. The higher the probability of that accuracy, the better the tool is.

If my choice of entry is a correct Cup and Handle Breakout pivot, with all the parameters fullfilled, BUT yet it fails, then it is not useful to me. Perhaps, this is the reason why ONeil insists in a 7% cut. Becos he recognises that the probability of his definition of Cup-Handle has a high chance of failure.

Subsequently, telling me a different entry point with almost exact description as the first failed point, but succeeds this time, is a pointless exercise to me. To see a entry succeed in hindsight, will not make me money. It does make me exclaim "wooda cooda"...and squeeze balls at best.

I am not interested to debunk anyone, especially MM, a person, i hold in high esteem, or put down any tool. I have said before that I have scoured many O'Neil's books, poured over many of his charts, and time and again, I cannot be convinced that his TA technique to pick an entry point is accurate. It is very accurate, however, when it is viewed historically.

anyways....very long and tedious post...

i only need your kind advice.....

is my suggested entry point wrong, and why ? if it is correct, then why did it fail ?

very kam sias...

2 parts in my response to your post above...

#1 ) one single point, usually does not form a resistance, however, it is a challenge nevertheless...more of a psychological barrier becos, u see, i see, tom sees, mary sees, and the whole world sees that as well...at the slightest sign of weakness rallying to that 37.86, you dump, i dump, tom dumps, mary dumps and the whole world dumps.. resulting in what seems to be a resistance point.

#2) if my suggested entry point @35.17 has the above concern, so does MM's choice of entry point in Oct, which is also about the same price as 35.17 if not even lower.

my original question is and remains, why is the May HIGH Volume/ Up Price not a valid entry point. as far as i can see, that entry point possesses about all that cup-handle formation describes.

You see, in hindsight, I can always justify ANY and ALL TA tools. however, this is not useful to me.

The test of usefulness of any TA tool is marked by its consistency in its predefined parameters being accurate in forecasting a price action. The higher the probability of that accuracy, the better the tool is.

If my choice of entry is a correct Cup and Handle Breakout pivot, with all the parameters fullfilled, BUT yet it fails, then it is not useful to me. Perhaps, this is the reason why ONeil insists in a 7% cut. Becos he recognises that the probability of his definition of Cup-Handle has a high chance of failure.

Subsequently, telling me a different entry point with almost exact description as the first failed point, but succeeds this time, is a pointless exercise to me. To see a entry succeed in hindsight, will not make me money. It does make me exclaim "wooda cooda"...and squeeze balls at best.

I am not interested to debunk anyone, especially MM, a person, i hold in high esteem, or put down any tool. I have said before that I have scoured many O'Neil's books, poured over many of his charts, and time and again, I cannot be convinced that his TA technique to pick an entry point is accurate. It is very accurate, however, when it is viewed historically.

anyways....very long and tedious post...

i only need your kind advice.....

is my suggested entry point wrong, and why ? if it is correct, then why did it fail ?

very kam sias...

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: CANSLIM & Momentum Investing

millionairemind wrote:K,

Simple answer - May - Aug 2006 - MKT WAS IN CORRECTION

Hope this helps.

Cheers,

mm

mm : i respectfully disagree that Oct is in any form or shape better than in May 06....simply by looking at POT chart...no other charts play a part in this discussion...it's purely picking an entry point based on 1 single chart reading.

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: CANSLIM & Momentum Investing

kennynah wrote:millionairemind wrote:K,

Simple answer - May - Aug 2006 - MKT WAS IN CORRECTION

Hope this helps.

Cheers,

mm

mm : i respectfully disagree that Oct is in any form or shape better than in May 06....simply by looking at POT chart...no other charts play a part in this discussion...it's purely picking an entry point based on 1 single chart reading.

K,

No worries.. Just my 2 cents.. there is nothing really wrong with the May entry point.. provided the mkt was in an uptrend... The entry into May failed because mkt went into a correction.

The M in CANSLIM is for mkt direction.. The only problem is May 14 2006 the market entered into a correction..when mkt direction is not in our favor, we do not go into long positions.

The next entry point was when it shaped up with another cup and a handle somewhere at the end of Sept... All the leaders break out within 13 weeks of a follow thro'..

mm

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: CANSLIM & Momentum Investing

ok...thanks MM...let's leave it at that...

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: CANSLIM & Momentum Investing

MM is rite....

a successful breakout shouldnt anyhow reverse.

so when do we get toi see nice successful breakouts in sg?hmmm

a successful breakout shouldnt anyhow reverse.

so when do we get toi see nice successful breakouts in sg?hmmm

"Die for something or Live for nothing"

-

bertyeo - Loafer

- Posts: 79

- Joined: Thu May 15, 2008 7:33 am

Return to Other Investment Instruments & Ideas

Who is online

Users browsing this forum: No registered users and 4 guests