End in sight, says Buffett

Billionaire Warren Buffett said the US residential real-estate slump will end by 2011, predicting that is how long it will take demand for homes to catch up with the supply.

"Within a year or so, residential housing problems should largely be behind us," Buffett wrote over the weekend in his annual letter to the shareholders of his Berkshire Hathaway.

"People thought it was good news a few years back when housing starts - the supply side of the picture - were running about two million annually," said Buffett, the chairman and chief executive officer of Berkshire. "But household formations - the demand side - only amounted to about 1.2 million."

Berkshire's own real-estate brokerage and a business that constructs prefabricated houses suffered amid the slump.

However, Berkshire itself saw fourth-quarter profit bounce back sharply, thanks to an unrealized US$1 billion (HK$7.8 billion) gain on derivative contracts and investments.

Berkshire generated US$3.056 billion in net income, or US$1,969 per Class A share, during the quarter. That is up from US$117 million net income, or US$76 per share, a year ago.

Source: BLOOMBERG

Warren Buffett 02 (Feb 10 - May 15)

Warren Buffett 02 (Mar 10 - Dec 14)

Warren Buffett 02 (Mar 10 - Dec 14)

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 112616

- Joined: Wed May 07, 2008 9:28 am

Re: Warren Buffett 1 (May 08 - Mar 10)

BUFFETT’S ANNUAL LETTER TO SHAREHOLDERS

The master has spoken in his freshly released letter to shareholders and as usual, it is filled with brilliance, hypocrisy and more brilliance. You can read the full letter here.

I will keep my personal thoughts on the letter short and sweet, but a few things stood out to me:

http://pragcap.com/buffetts-annual-lett ... areholders

The master has spoken in his freshly released letter to shareholders and as usual, it is filled with brilliance, hypocrisy and more brilliance. You can read the full letter here.

I will keep my personal thoughts on the letter short and sweet, but a few things stood out to me:

http://pragcap.com/buffetts-annual-lett ... areholders

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 112616

- Joined: Wed May 07, 2008 9:28 am

Re: Warren Buffett 1 (May 08 - Mar 10)

winston wrote:BUFFETT’S ANNUAL LETTER TO SHAREHOLDERS

The master has spoken in his freshly released letter to shareholders and as usual, it is filled with brilliance, hypocrisy and more brilliance. You can read the full letter here.

I will keep my personal thoughts on the letter short and sweet, but a few things stood out to me:

http://pragcap.com/buffetts-annual-lett ... areholders

From the article above, it link to another article with the following :

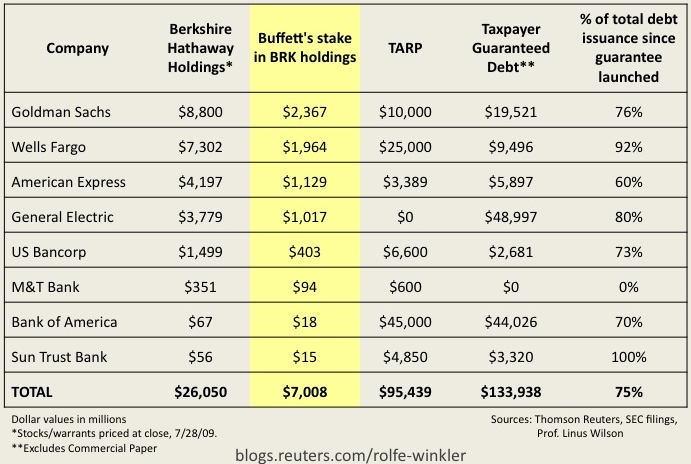

the chart says it all

1. Always wait for the setup. NO SETUP; NO TRADE

2. The trend will END but I don't know WHEN.

TA and Options stuffs on InvestIdeas:

The Ichimoku Thread | Option Strategies Thread | Japanese Candlesticks Thread

2. The trend will END but I don't know WHEN.

TA and Options stuffs on InvestIdeas:

The Ichimoku Thread | Option Strategies Thread | Japanese Candlesticks Thread

-

iam802 - Big Boss

- Posts: 5940

- Joined: Wed May 07, 2008 1:14 am

Re: Warren Buffett 1 (May 08 - Mar 10)

From his famous 1st page, it seems BRK under performs S&P during a recovery/irrational year. Like 1975, 1999 (dot com boom), 2003, and recent 2009. Their businesses and investment portfolio are quite defensive.

- kanglc

- Loafer

- Posts: 70

- Joined: Mon Jul 07, 2008 6:16 pm

Re: Warren Buffett 1 (May 08 - Mar 10)

Buffett's tips for new investors By The Wall Street Journal

Every few years, critics say Warren Buffett has lost his touch. He's too old and too old-fashioned, they claim. He doesn't get it anymore. This time he's wrong.

Quiz: How much risk can you tolerate?

It happened during the dot-com bubble, when Buffett was mocked for refusing to join the party. And it happened again last year. As the Dow Jones Industrial Average ($INDU) tumbled below 7,000, Buffett came under fire for having jumped into the crisis too early and too boldly, making big bets on Goldman Sachs (GS, news, msgs) and General Electric (GE, news, msgs) during the fall of 2008, and urging the public to plunge into shares.

Now it's time for those critics to sit down for their traditional three-course meal: humble pie, their own words and crow.

On Saturday, Buffett's Berkshire Hathaway (BRK.A, news, msgs) reported that net earnings rocketed 61% last year to $5,193 per share, while book value jumped 20% to a record high. Berkshire's Class A shares, which slumped to nearly $70,000 last year, have rebounded to $120,000.

Those bets on GE and Goldman? They've made billions so far. And anyone who took Buffett's advice and invested in the stock market in October 2008, even through a simple index fund, is up about 25%.

This is nothing new, of course. Anyone who held a $10,000 stake in Berkshire Hathaway at the start of 1965 has about $80 million today.

How does he do it? Buffett explained his beliefs to new investors in his letter to stockholders Saturday:

Stay liquid. "We will never become dependent on the kindness of strangers," he wrote. "We will always arrange our affairs so that any requirements for cash we may conceivably have will be dwarfed by our own liquidity. Moreover, that liquidity will be constantly refreshed by a gusher of earnings from our many and diverse businesses."

Buy when everyone else is selling. "We've put a lot of money to work during the chaos of the last two years. It's been an ideal period for investors: A climate of fear is their best friend. . . . Big opportunities come infrequently. When it's raining gold, reach for a bucket, not a thimble."

Don't buy when everyone else is buying. "Those who invest only when commentators are upbeat end up paying a heavy price for meaningless reassurance," Buffett wrote. The obvious corollary is to be patient. You can only buy when everyone else is selling if you have held your fire when everyone was buying.

Value, value, value. "In the end, what counts in investing is what you pay for a business -- through the purchase of a small piece of it in the stock market -- and what that business earns in the succeeding decade or two."

Don't get suckered by big growth stories. Buffett reminded investors that he and Berkshire Vice Chairman Charlie Munger "avoid businesses whose futures we can't evaluate, no matter how exciting their products may be."

Diversify your portfolio

Most investors who bet on the auto industry in 1910, planes in 1930 or TV makers in 1950 ended up losing their shirts, even though the products really did change the world. "Dramatic growth" doesn't always lead to high profit margins and returns on capital. China, anyone?

Understand what you own. "Investors who buy and sell based upon media or analyst commentary are not for us," Buffett wrote.

"We want partners who join us at Berkshire because they wish to make a long-term investment in a business they themselves understand and because it's one that follows policies with which they concur."

Defense beats offense. "Though we have lagged the S&P in some years that were positive for the market, we have consistently done better than the S&P in the 11 years during which it delivered negative results. In other words, our defense has been better than our offense, and that's likely to continue."

Timely advice from Buffett for turbulent times.

This article was reported by Brett Arends for The Wall Street Journal.

http://articles.moneycentral.msn.com/le ... stors.aspx

Every few years, critics say Warren Buffett has lost his touch. He's too old and too old-fashioned, they claim. He doesn't get it anymore. This time he's wrong.

Quiz: How much risk can you tolerate?

It happened during the dot-com bubble, when Buffett was mocked for refusing to join the party. And it happened again last year. As the Dow Jones Industrial Average ($INDU) tumbled below 7,000, Buffett came under fire for having jumped into the crisis too early and too boldly, making big bets on Goldman Sachs (GS, news, msgs) and General Electric (GE, news, msgs) during the fall of 2008, and urging the public to plunge into shares.

Now it's time for those critics to sit down for their traditional three-course meal: humble pie, their own words and crow.

On Saturday, Buffett's Berkshire Hathaway (BRK.A, news, msgs) reported that net earnings rocketed 61% last year to $5,193 per share, while book value jumped 20% to a record high. Berkshire's Class A shares, which slumped to nearly $70,000 last year, have rebounded to $120,000.

Those bets on GE and Goldman? They've made billions so far. And anyone who took Buffett's advice and invested in the stock market in October 2008, even through a simple index fund, is up about 25%.

This is nothing new, of course. Anyone who held a $10,000 stake in Berkshire Hathaway at the start of 1965 has about $80 million today.

How does he do it? Buffett explained his beliefs to new investors in his letter to stockholders Saturday:

Stay liquid. "We will never become dependent on the kindness of strangers," he wrote. "We will always arrange our affairs so that any requirements for cash we may conceivably have will be dwarfed by our own liquidity. Moreover, that liquidity will be constantly refreshed by a gusher of earnings from our many and diverse businesses."

Buy when everyone else is selling. "We've put a lot of money to work during the chaos of the last two years. It's been an ideal period for investors: A climate of fear is their best friend. . . . Big opportunities come infrequently. When it's raining gold, reach for a bucket, not a thimble."

Don't buy when everyone else is buying. "Those who invest only when commentators are upbeat end up paying a heavy price for meaningless reassurance," Buffett wrote. The obvious corollary is to be patient. You can only buy when everyone else is selling if you have held your fire when everyone was buying.

Value, value, value. "In the end, what counts in investing is what you pay for a business -- through the purchase of a small piece of it in the stock market -- and what that business earns in the succeeding decade or two."

Don't get suckered by big growth stories. Buffett reminded investors that he and Berkshire Vice Chairman Charlie Munger "avoid businesses whose futures we can't evaluate, no matter how exciting their products may be."

Diversify your portfolio

Most investors who bet on the auto industry in 1910, planes in 1930 or TV makers in 1950 ended up losing their shirts, even though the products really did change the world. "Dramatic growth" doesn't always lead to high profit margins and returns on capital. China, anyone?

Understand what you own. "Investors who buy and sell based upon media or analyst commentary are not for us," Buffett wrote.

"We want partners who join us at Berkshire because they wish to make a long-term investment in a business they themselves understand and because it's one that follows policies with which they concur."

Defense beats offense. "Though we have lagged the S&P in some years that were positive for the market, we have consistently done better than the S&P in the 11 years during which it delivered negative results. In other words, our defense has been better than our offense, and that's likely to continue."

Timely advice from Buffett for turbulent times.

This article was reported by Brett Arends for The Wall Street Journal.

http://articles.moneycentral.msn.com/le ... stors.aspx

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 112616

- Joined: Wed May 07, 2008 9:28 am

Re: Warren Buffett 1 (May 08 - May 10)

I remember that WB made a field trip to Canada to learn abt oil sands and subsequently bought a stake in ConocoPhilips, which turned out to be a bad investment. And now the Chinese, who seemingly have too much $$ to cast away, buys a stake  :-

:-

China's state-owned Sinopec plans to buy ConocoPhillips' [COP 55.96 0.64 (+1.16%) ] stake in the huge Syncrude project in Canada's oil sands for $4.65 billion, marking one of the Asian country's largest investments ever in North America.

Please be forewarned that you are reading a post by an otiose housewife.

**

** **

** @@

@@

**

** **

** @@

@@

-

LenaHuat - Big Boss

- Posts: 3066

- Joined: Thu May 08, 2008 9:35 am

Re: Warren Buffett 1 (May 08 - May 10)

It has been reported that it's cheaper to extract crude oil from these Canadian sands that traditional oil fields

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: Warren Buffett 1 (May 08 - May 10)

Hi K

I see but I read somewhere that the oil does not meet sulphur limits.

I see but I read somewhere that the oil does not meet sulphur limits.

Please be forewarned that you are reading a post by an otiose housewife.

**

** **

** @@

@@

**

** **

** @@

@@

-

LenaHuat - Big Boss

- Posts: 3066

- Joined: Thu May 08, 2008 9:35 am

Re: Warren Buffett 1 (May 08 - May 10)

kennynah wrote:It has been reported that it's cheaper to extract crude oil from these Canadian sands that traditional oil fields

No, I dont think so. I think they need to pump a lot of steam into those Oil Sands before they can extract them. I heard only when oil prices are very high, can it be feasible.

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 112616

- Joined: Wed May 07, 2008 9:28 am

Re: Warren Buffett 1 (May 08 - May 10)

winston wrote:kennynah wrote:It has been reported that it's cheaper to extract crude oil from these Canadian sands that traditional oil fields

No, I dont think so. I think they need to pump a lot of steam into those Oil Sands before they can extract them. I heard only when oil prices are very high, can it be feasible.

The tar sands in Alberta is economically feasible once crude crosses $40/b.

Producers must mix it with water, heated using natural gas, to separate the oil from the sand. Some do all this underground by pumping steam into deeper deposits and pumping out the resulting slurry. Both processes produce bitumen, which needs extra treatment before it can be refined into petrol. All this consumes lots of energy, and so costs C$20-25 ($18-23) per barrel of output in operating expenses alone.

But these tar sands does not meet sulfur specs and needs to be further treated.

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Who is online

Users browsing this forum: No registered users and 2 guests