What Lies Ahead in 2010?

by: Clive Corcoran December 29, 2009

Previously I have held back from providing any traceable documentation of crystal ball gazing for the coming year, but this year, partly as a challenge to myself, I have succumbed to the temptation and below offer a collection of my very broad prognostications for 2010.

Within the larger time-frame context, I am still of the view that the world economy faces a risk of continuing deflation as the structural bear market dynamics, which took hold in 2000 alleviated periodically with bubble blowing exercises designed especially to re-inflate US asset prices, are still extant and may well haunt the global capital markets for several more years.

Having said that, the extraordinary initiatives of central banks and policy makers, throughout late 2008 and all of 2009, to bailout any business that has been deemed to be strategically important or too inter-connected to fail, has created a highly unusual financial backdrop which has supported a new kind of risk taking during the last three quarters of 2009.

Adventurous asset managers and proprietary trading desks have been enticed back in to equity and commodity markets, to provide the liquidity lifeblood which modern financial engineering requires, by a not so subtly hidden safety net which takes the form of an accident protection package which is completely underwritten by the full faith and credit of the taxpayers of most of the world’s economies.

US Equities

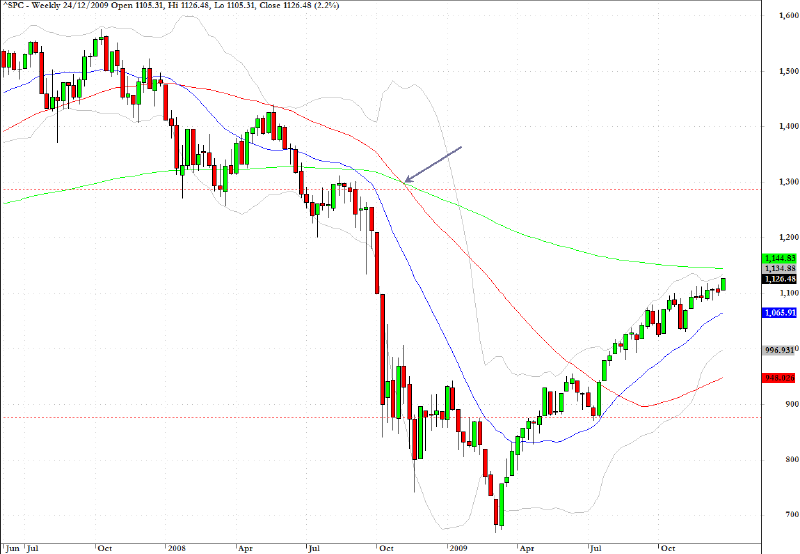

I see the S&P 500 hitting both 1280 and 870 during 2010, and it seems more likely that the 1280 comes in the first half and the 870 comes during the summer months or second half of the year. Both are key technical levels, as seen on the chart below, and the timing will have to do with the market's perception of when the Fed is planning to exit its super-accommodating monetary policy. I am sure there will be some significant missteps regarding the exact timing and mechanics of the exit strategy, and traders as well as the Fed itself could easily become confused by the economic data and the underlying strength of the banking system.

However, at some point during 2010, unless there is another systemic crisis, the Fed will have to begin raising short term rates and draining liquidity from the financial system to maintain any semblance of credibility. At the first real evidence that the die is cast in favor of higher rates, the market, which prides itself on its ability to discount all known information, will suddenly realize that it has not fully discounted the actuality of higher rates and will, almost certainly, panic. There could easily be a series of nasty sell-offs and that is why I anticipate a re-testing of the July 2009 lows around 870. Should this level fail, which I tend to think will not happen, then an S&P 500 level with a seven as the first digit becomes a real possibility.

Since I believe that the US stock market will essentially gyrate within the range just outlined, in an almost bi-polar fashion during 2010, I do not have firm view on where we shall end the year but my hunch is that it may not be too far from where we end this year.

Rest of Forecasts

US - 2010 Predictions

Re: US - 2010 Predictions

Not what but when.

-

mojo_ - Foreman

- Posts: 371

- Joined: Sun May 11, 2008 6:44 pm

Re: US - 2010 Predictions

Bulls On Parade

Brian S. Wesbury and Robert Stein, 12.29.09, 12:01 AM EST

Stocks could rally by late 2010 with further gains to come.

http://www.forbes.com/2009/12/28/stocks ... stein.html

Brian S. Wesbury and Robert Stein, 12.29.09, 12:01 AM EST

Stocks could rally by late 2010 with further gains to come.

We expect stocks to rally to 13,000 by the end of 2010, with further gains ahead for 2011. If there is one wild card that could upset this forecast, it's the health care bill now wending its way through Congress toward President Obama's desk.

We think the Senate bill is already priced into the market. But a final law along the lines of what House Speaker Pelosi wants--which is unlikely--could cap the Dow at 12,000 and slow its growth in the future.

Much like the 1970s, government policy would be detrimental to long-term stock market valuation.

http://www.forbes.com/2009/12/28/stocks ... stein.html

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 113692

- Joined: Wed May 07, 2008 9:28 am

Re: US - 2010 Predictions

Hedge Fund Guru: Stocks Will Test March Lows, Fall 40 Percent By: Dan Weil

Hedge fund manager Eric Sprott predicts stock prices will plummet 40 percent, as the economy remains in recession.

The Standard & Poor’s 500 Index will drop below its March 12 closing low of 676.53, he told Bloomberg. That was the lowest close in 12 years.

“We’re in a bear market that will last 15 or 20 years,†said Sprott, CEO of Sprott Asset Management.

He notes that despite investor optimism, payrolls continue to shrink, with unemployment at 10 percent.

The low level of interest rates is artificial, engineered by the Federal Reserve’s bond purchases, he says. Those purchases are scheduled to end by March 31.

Once that happens, demand for bonds will drop, pushing interest rates higher, Sprott says.

And rising rates will stifle the economy.

If the Fed decides to resume the bond buying, then the dollar will be in trouble, as investors lose confidence in Fed policy, he says.

“If they announce another quantitative easing, trust me, the gold price will go up another 50 bucks that day,†Sprott said.

He has been bullish on the precious metal for at least eight years.

Nobel laureate economist Paul Krugman shares some of Sprott’s concern about the economy.

“What we’ve got right now is a recovery that first of all isn’t showing up very much in jobs yet. It’s being driven by fiscal stimulus, which is going to fade out in the second half of next year,†Krugman told ABC.

Adding to the dire forecasts is Mohamed El-Erian, chief executive of giant bond manager Pimco.

He says the recovery may be gaining steam but is no different than a kid who eats too much candy.

“We're on a sugar high,†El-Erian says. “It feels good for a while but is unsustainable.â€

He says the recent burst of economic activity fed by government spending and near-zero interest rates will soon peter out.

El-Erian says stocks will drop 10 percent in the space of three or four weeks, bringing the S&P 500 Index to below 1,000 — though he's not predicting when.

http://moneynews.com/Headline/Hedgefund ... /id/345002

Hedge fund manager Eric Sprott predicts stock prices will plummet 40 percent, as the economy remains in recession.

The Standard & Poor’s 500 Index will drop below its March 12 closing low of 676.53, he told Bloomberg. That was the lowest close in 12 years.

“We’re in a bear market that will last 15 or 20 years,†said Sprott, CEO of Sprott Asset Management.

He notes that despite investor optimism, payrolls continue to shrink, with unemployment at 10 percent.

The low level of interest rates is artificial, engineered by the Federal Reserve’s bond purchases, he says. Those purchases are scheduled to end by March 31.

Once that happens, demand for bonds will drop, pushing interest rates higher, Sprott says.

And rising rates will stifle the economy.

If the Fed decides to resume the bond buying, then the dollar will be in trouble, as investors lose confidence in Fed policy, he says.

“If they announce another quantitative easing, trust me, the gold price will go up another 50 bucks that day,†Sprott said.

He has been bullish on the precious metal for at least eight years.

Nobel laureate economist Paul Krugman shares some of Sprott’s concern about the economy.

“What we’ve got right now is a recovery that first of all isn’t showing up very much in jobs yet. It’s being driven by fiscal stimulus, which is going to fade out in the second half of next year,†Krugman told ABC.

Adding to the dire forecasts is Mohamed El-Erian, chief executive of giant bond manager Pimco.

He says the recovery may be gaining steam but is no different than a kid who eats too much candy.

“We're on a sugar high,†El-Erian says. “It feels good for a while but is unsustainable.â€

He says the recent burst of economic activity fed by government spending and near-zero interest rates will soon peter out.

El-Erian says stocks will drop 10 percent in the space of three or four weeks, bringing the S&P 500 Index to below 1,000 — though he's not predicting when.

http://moneynews.com/Headline/Hedgefund ... /id/345002

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 113692

- Joined: Wed May 07, 2008 9:28 am

Re: US - 2010 Predictions

Why I'm Buying Stocks This Year By Frank Curzio, Penny Stock Specialist

Right now, it's easy to make the case that sometime this year we'll be in the middle of a stock and credit bubble.

This potential bubble has its roots in the $787 billion American Recovery and Reinvestment Act (ARRA) passed early last year. It's the largest stimulus package in our nation's history. Billions in "free money" is being passed around to the infrastructure, technology, and energy sectors.

And only 32% of the stimulus has been spent thus far. Based on the laws of the ARRA, most of the remaining cash must be spent in 2010 and 2011. In other words, there will be a huge amount of cash flowing into companies over the next two years.

The surge in gold and commodity prices supports the idea that we'll eventually see inflation and bubbles from the massive government spending... especially with our government throwing money into every problem area of the market.

So it would be difficult for any analyst to say they are not concerned about future bubbles or inflation. I certainly am.

But here's what I'm about to show you: Bubbles are not created overnight. It could take up to four years before another credit crisis or inflation hits the markets.

The fed-funds rate is the interest rate banks charge each other for overnight loans. The Federal Open Market Committee (FOMC) controls the fed-funds rate and may lower it to spur growth or raise it to combat inflation.

In March 2001, the U.S. economy slipped into recession. A recession is defined as two consecutive quarters in which gross domestic product (GDP) is negative. To make it easier for businesses to get capital for projects and hiring, the Fed began to lower ("ease") short-term interest rates.

The Fed lowered rates more aggressively later in 2001 and into 2002 because consumers were reluctant to spend after the September 11 terrorist attacks.

Let's look at the chart of the S&P 500 during that timeframe:

The Fed pushed interest rates to 1% in 2003 and 2004. Notice the huge turnaround during this timeframe in the S&P 500. Lowering the fed-funds rate to unprecedented levels resulted in huge economic growth and a spike in the stock market through 2007.

Lower interest rates made lending too easy. Almost anyone on any pay scale could get a mortgage. In 2008, we saw the negative effects of the easy-money policy as the housing and credit bubble popped. The S&P 500 crashed to 666 from a peak of 1,560... That's nearly 60%!

But as you can see from the chart, it took roughly four years for the credit and market bubble to burst from the time interest rates were at record lows. So it took about four years from the time when the fed-funds rate was at 1% (2003 to 2004) until the stock market crashed (2008).

There is no denying easy money leads to bubbles. But my point is, there's a long time between the boom and the bust.

Today is similar to 2004. Interest rates are at historic lows (0% to 0.25%). The stock market is trending higher. Economic data including manufacturing and unemployment bounced off lows. Plus, corporate profits are rebounding.

Sure, the creation of new money through stimulus plans coupled with low interest rates will create future bubbles. And I don't expect the time between the next boom and bust cycle to take four years – especially with the deficit at $1.5 trillion and unemployment above historical norms.

But it won't happen over the next 12 months either. Not as long as the government keeps the printing press running.

Could the bears be right much sooner than I think? Sure... anything can happen. But big shifts in monetary policy and credit flows happen glacially. They take much longer to play out than impatient investors expect. And history suggests this one will take at least a year. That's why I'm bullish on stocks for 2010.

Source: Daily Wealth

Right now, it's easy to make the case that sometime this year we'll be in the middle of a stock and credit bubble.

This potential bubble has its roots in the $787 billion American Recovery and Reinvestment Act (ARRA) passed early last year. It's the largest stimulus package in our nation's history. Billions in "free money" is being passed around to the infrastructure, technology, and energy sectors.

And only 32% of the stimulus has been spent thus far. Based on the laws of the ARRA, most of the remaining cash must be spent in 2010 and 2011. In other words, there will be a huge amount of cash flowing into companies over the next two years.

The surge in gold and commodity prices supports the idea that we'll eventually see inflation and bubbles from the massive government spending... especially with our government throwing money into every problem area of the market.

So it would be difficult for any analyst to say they are not concerned about future bubbles or inflation. I certainly am.

But here's what I'm about to show you: Bubbles are not created overnight. It could take up to four years before another credit crisis or inflation hits the markets.

The fed-funds rate is the interest rate banks charge each other for overnight loans. The Federal Open Market Committee (FOMC) controls the fed-funds rate and may lower it to spur growth or raise it to combat inflation.

In March 2001, the U.S. economy slipped into recession. A recession is defined as two consecutive quarters in which gross domestic product (GDP) is negative. To make it easier for businesses to get capital for projects and hiring, the Fed began to lower ("ease") short-term interest rates.

The Fed lowered rates more aggressively later in 2001 and into 2002 because consumers were reluctant to spend after the September 11 terrorist attacks.

Let's look at the chart of the S&P 500 during that timeframe:

The Fed pushed interest rates to 1% in 2003 and 2004. Notice the huge turnaround during this timeframe in the S&P 500. Lowering the fed-funds rate to unprecedented levels resulted in huge economic growth and a spike in the stock market through 2007.

Lower interest rates made lending too easy. Almost anyone on any pay scale could get a mortgage. In 2008, we saw the negative effects of the easy-money policy as the housing and credit bubble popped. The S&P 500 crashed to 666 from a peak of 1,560... That's nearly 60%!

But as you can see from the chart, it took roughly four years for the credit and market bubble to burst from the time interest rates were at record lows. So it took about four years from the time when the fed-funds rate was at 1% (2003 to 2004) until the stock market crashed (2008).

There is no denying easy money leads to bubbles. But my point is, there's a long time between the boom and the bust.

Today is similar to 2004. Interest rates are at historic lows (0% to 0.25%). The stock market is trending higher. Economic data including manufacturing and unemployment bounced off lows. Plus, corporate profits are rebounding.

Sure, the creation of new money through stimulus plans coupled with low interest rates will create future bubbles. And I don't expect the time between the next boom and bust cycle to take four years – especially with the deficit at $1.5 trillion and unemployment above historical norms.

But it won't happen over the next 12 months either. Not as long as the government keeps the printing press running.

Could the bears be right much sooner than I think? Sure... anything can happen. But big shifts in monetary policy and credit flows happen glacially. They take much longer to play out than impatient investors expect. And history suggests this one will take at least a year. That's why I'm bullish on stocks for 2010.

Source: Daily Wealth

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 113692

- Joined: Wed May 07, 2008 9:28 am

Re: US - 2010 Predictions

The Decennial Pattern – Years ending in 0 By Barry Ritholtz

Fascinating pair of charts from The Chart Store looking at market performance based upon years ending number — 1s, 2s, 3s, etc.

Not that I am a believer in this, but the zeros have not fared particularly well:

http://www.ritholtz.com/blog/2010/01/th ... l-pattern/

Fascinating pair of charts from The Chart Store looking at market performance based upon years ending number — 1s, 2s, 3s, etc.

Not that I am a believer in this, but the zeros have not fared particularly well:

http://www.ritholtz.com/blog/2010/01/th ... l-pattern/

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 113692

- Joined: Wed May 07, 2008 9:28 am

Re: US - 2010 Predictions

Bob Doll’s crystal ball into 2010 and the next decade

This post is a guest contribution by Dian Chu, market analyst, trader and author of the Economic Forecasts and Opinions blog.

BlackRock, Inc. (BLK) Vice Chairman Bob Doll has been putting out annual predictions for 15 years. Doll, who helps oversee about $3.2 trillion at BlackRock, the world’s biggest asset manager, just released his ten predictions for 2010 and for the next ten years. Eleven of the twelve predictions he made for 2009 were right. Below are highlights of his latest market forecasts.

In general, Doll believes US stocks will outperform cash, Treasuries and other developed economies with S&P 500 rallying another 12% this year, reaching 1250 from its January 4 open of 1116.56.

The US is on its way to recovery, but the economy will grow slower than that of a typical recovery mainly due to heavy debt load. Inflation will be a “non-issue†in the US, Europe and Japan this year even with rising prices of gold and oil. The US dollar will likely remain weak in a broad trading range with the euro and yen.

Doll also noted structural issues in the economy would continue to present problems. Chief among them are “ongoing consumer deleveraging; a banking system facing deteriorating loan quality and an increasing yet uncertain regulatory environment; securitizations markets still largely shuttered, and a real estate market that may still be healing for several years.â€

Emerging-market stocks and economies will outperform the developed world this year. His â€favorite secular story in the emerging markets remains Brazil.†(Note: Barclays Capital recently warned of a possible Bovespa (BVSP) correction in Q1 or Q2 this year based on technical chart analysis).

Furthermore, he advised investors should prepare for rising taxes following healthcare reform and protectionist government policies if the unemployment rate remains high.

Doll favors healthcare (especially managed care and healthcare services), information technology and telecommunications sectors. However, he advised underweight on financials as they are likely to continue to underperform.

Note: Doll’s predictions differ from that of Blackstone Group LP’s Byron Wien’s. Wien’s ten predictions for the new year call for the S&P 500 to finish 2010 flat, US GDP to expand about 5% and financials to outperform the market.

Doll’s predictions for 2010:

US economy grows above 3%, outpacing the developed world.

Unemployment to remain high, but with positive job growth.

Earnings rise significantly - 20-30% on cost & productivity advantage, particularly from a weak dollar.

Inflation a non-issue for the developed countries, but oil and gold will still go up.

Interest rate rises on Treasury curve - 10-year Treasury target: 4.5%.

Stock outperform cash and Treasuries - S&P 500 should rally another 12%.

Emerging markets outperform.

Health care, IT & Telecom outperform.

More M&As.

Dems stay in control of the Congress.

Source: Dian Chu, Economic Forecasts & Opinions, January 7, 2010.

http://www.investmentpostcards.com/

This post is a guest contribution by Dian Chu, market analyst, trader and author of the Economic Forecasts and Opinions blog.

BlackRock, Inc. (BLK) Vice Chairman Bob Doll has been putting out annual predictions for 15 years. Doll, who helps oversee about $3.2 trillion at BlackRock, the world’s biggest asset manager, just released his ten predictions for 2010 and for the next ten years. Eleven of the twelve predictions he made for 2009 were right. Below are highlights of his latest market forecasts.

In general, Doll believes US stocks will outperform cash, Treasuries and other developed economies with S&P 500 rallying another 12% this year, reaching 1250 from its January 4 open of 1116.56.

The US is on its way to recovery, but the economy will grow slower than that of a typical recovery mainly due to heavy debt load. Inflation will be a “non-issue†in the US, Europe and Japan this year even with rising prices of gold and oil. The US dollar will likely remain weak in a broad trading range with the euro and yen.

Doll also noted structural issues in the economy would continue to present problems. Chief among them are “ongoing consumer deleveraging; a banking system facing deteriorating loan quality and an increasing yet uncertain regulatory environment; securitizations markets still largely shuttered, and a real estate market that may still be healing for several years.â€

Emerging-market stocks and economies will outperform the developed world this year. His â€favorite secular story in the emerging markets remains Brazil.†(Note: Barclays Capital recently warned of a possible Bovespa (BVSP) correction in Q1 or Q2 this year based on technical chart analysis).

Furthermore, he advised investors should prepare for rising taxes following healthcare reform and protectionist government policies if the unemployment rate remains high.

Doll favors healthcare (especially managed care and healthcare services), information technology and telecommunications sectors. However, he advised underweight on financials as they are likely to continue to underperform.

Note: Doll’s predictions differ from that of Blackstone Group LP’s Byron Wien’s. Wien’s ten predictions for the new year call for the S&P 500 to finish 2010 flat, US GDP to expand about 5% and financials to outperform the market.

Doll’s predictions for 2010:

US economy grows above 3%, outpacing the developed world.

Unemployment to remain high, but with positive job growth.

Earnings rise significantly - 20-30% on cost & productivity advantage, particularly from a weak dollar.

Inflation a non-issue for the developed countries, but oil and gold will still go up.

Interest rate rises on Treasury curve - 10-year Treasury target: 4.5%.

Stock outperform cash and Treasuries - S&P 500 should rally another 12%.

Emerging markets outperform.

Health care, IT & Telecom outperform.

More M&As.

Dems stay in control of the Congress.

Source: Dian Chu, Economic Forecasts & Opinions, January 7, 2010.

http://www.investmentpostcards.com/

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 113692

- Joined: Wed May 07, 2008 9:28 am

Re: US - 2010 Predictions

2010 Forecast: The Year of Uncertainty

2010: A Year of Uncertainty

"Rocking Even Me"

Prisoners of Our Preconceptions

The Statistical Recovery

The Great Experiment

Whither the Fed?

http://www.investorsinsight.com/blogs/t ... ainty.aspx

2010: A Year of Uncertainty

"Rocking Even Me"

Prisoners of Our Preconceptions

The Statistical Recovery

The Great Experiment

Whither the Fed?

http://www.investorsinsight.com/blogs/t ... ainty.aspx

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 113692

- Joined: Wed May 07, 2008 9:28 am

Re: US - 2010 Predictions

Wow ... all the top market timers are very bullish. Am I missing somethig big or what ?

Top Market Timers Give Their 2010 Outlooks By MARK HULBERT

What can the market do for an encore?

For guidance, I decided -- as I often do -- to turn to those investment newsletters with the best market timing records in the Hulbert Financial Digest's ranking system. Specifically, I determined which newsletters were able to jump over three market timing performance hurdles -- each demanding enough in itself, but collectively particularly so:

*market timing performance ahead of a buy-and-hold on a risk-adjusted basis during the 2002-2007 bull market,

*market timing performance ahead of a buy-and-hold on a risk-adjusted basis during the 2007-2009 bear market,

*market timing performance ahead of a buy-and-hold on a risk-adjusted basis over the entire 10-year period through the end of 2009.

As fate would have it, only seven newsletters jumped over all three hurdles. One of them discontinued publication at the end of 2009, and two more are edited by the same adviser.

This leaves just five in our panel of experts to consult about what 2010 has in store for the stock market.

Here are their latest views (the newsletters are listed alphabetically).

*Blue Chip Investor (Steven Check) -- Bullish. To be sure, Check is not a short-term market timer. But he does vary the amount of cash in his newsletter's model portfolio, and currently he has allocated just 0.6% to cash.

Furthermore, Check maintains a market timing model based on the difference between the stock market's price/earnings ratio and the yield on triple-A rated corporate bonds. Based on the issue of his newsletter published earlier this week, that model currently rates the stock market as being "undervalued," though not "extremely undervalued" as it was one year ago.

*Bob Brinker's Marketimer (Robert Brinker) -- Bullish. In his latest issue, published earlier this week, in which he reported that his market timing model is bullish and his model portfolios are fully invested, Brinker wrote: "Our indicators suggest that a new cyclical bear market decline in excess of 20% is not likely to begin during the winter season.

While it is true that cyclical bull market corrections can occur at any time, we would regard any such pullback as a health restoring event if it were to occur in the weeks ahead. Cyclical bull market corrections are usually contained with a range of five to ten percent, and are followed by significant rallies to new cyclical bull market highs."

*The Chartist & The Chartist Mutual Fund Letter (Dan Sullivan) -- Bullish. In his latest issue, written in late December, Sullivan wrote: "We're betting that the bull market will remain intact over the next year. That's our best guesstimate, but in all candor, we really don't know what the market is going to do over the next 12 months or 6 months or, for that matter, 3 months; and nobody else knows either." Until his models turn bearish, however, Sullivan's model portfolios remain fully invested.

*Fidelity Independent Adviser (Donald Dion) -- Bullish. Dion does not hazard a prediction about the stock market's trend for all of 2010, preferring instead to write that the year will test the stock market's "strength and stamina." In the meantime, however, Dion is keeping his equity-oriented model portfolios fully invested.

*Fidelity Sector Investor (James Lowell) -- Bullish. In his latest letter, published earlier this week, Lowell wrote: "I think 2010 will be another 20% gainer," though he also predicts that such a belief "will be hard to hold as we hit the troughs that 2010 has in store for us." Lowell's so-called Market Masters Portfolio is 87% invested in various Fidelity sector funds, with the remaining 13% invested in a foreign stock fund.

The bottom line? All five of our panel of experts are bullish, with an average recommended equity exposure level of 97%.

To be sure, their bullish consensus is not a guarantee that the bull market will continue. No such guarantees exist in this business, of course. Furthermore, there are other ways of slicing and dicing the data in which the message would be less bullish.

Still, at least this straw in the wind is very bullish indeed for 2010.

Top Market Timers Give Their 2010 Outlooks By MARK HULBERT

What can the market do for an encore?

For guidance, I decided -- as I often do -- to turn to those investment newsletters with the best market timing records in the Hulbert Financial Digest's ranking system. Specifically, I determined which newsletters were able to jump over three market timing performance hurdles -- each demanding enough in itself, but collectively particularly so:

*market timing performance ahead of a buy-and-hold on a risk-adjusted basis during the 2002-2007 bull market,

*market timing performance ahead of a buy-and-hold on a risk-adjusted basis during the 2007-2009 bear market,

*market timing performance ahead of a buy-and-hold on a risk-adjusted basis over the entire 10-year period through the end of 2009.

As fate would have it, only seven newsletters jumped over all three hurdles. One of them discontinued publication at the end of 2009, and two more are edited by the same adviser.

This leaves just five in our panel of experts to consult about what 2010 has in store for the stock market.

Here are their latest views (the newsletters are listed alphabetically).

*Blue Chip Investor (Steven Check) -- Bullish. To be sure, Check is not a short-term market timer. But he does vary the amount of cash in his newsletter's model portfolio, and currently he has allocated just 0.6% to cash.

Furthermore, Check maintains a market timing model based on the difference between the stock market's price/earnings ratio and the yield on triple-A rated corporate bonds. Based on the issue of his newsletter published earlier this week, that model currently rates the stock market as being "undervalued," though not "extremely undervalued" as it was one year ago.

*Bob Brinker's Marketimer (Robert Brinker) -- Bullish. In his latest issue, published earlier this week, in which he reported that his market timing model is bullish and his model portfolios are fully invested, Brinker wrote: "Our indicators suggest that a new cyclical bear market decline in excess of 20% is not likely to begin during the winter season.

While it is true that cyclical bull market corrections can occur at any time, we would regard any such pullback as a health restoring event if it were to occur in the weeks ahead. Cyclical bull market corrections are usually contained with a range of five to ten percent, and are followed by significant rallies to new cyclical bull market highs."

*The Chartist & The Chartist Mutual Fund Letter (Dan Sullivan) -- Bullish. In his latest issue, written in late December, Sullivan wrote: "We're betting that the bull market will remain intact over the next year. That's our best guesstimate, but in all candor, we really don't know what the market is going to do over the next 12 months or 6 months or, for that matter, 3 months; and nobody else knows either." Until his models turn bearish, however, Sullivan's model portfolios remain fully invested.

*Fidelity Independent Adviser (Donald Dion) -- Bullish. Dion does not hazard a prediction about the stock market's trend for all of 2010, preferring instead to write that the year will test the stock market's "strength and stamina." In the meantime, however, Dion is keeping his equity-oriented model portfolios fully invested.

*Fidelity Sector Investor (James Lowell) -- Bullish. In his latest letter, published earlier this week, Lowell wrote: "I think 2010 will be another 20% gainer," though he also predicts that such a belief "will be hard to hold as we hit the troughs that 2010 has in store for us." Lowell's so-called Market Masters Portfolio is 87% invested in various Fidelity sector funds, with the remaining 13% invested in a foreign stock fund.

The bottom line? All five of our panel of experts are bullish, with an average recommended equity exposure level of 97%.

To be sure, their bullish consensus is not a guarantee that the bull market will continue. No such guarantees exist in this business, of course. Furthermore, there are other ways of slicing and dicing the data in which the message would be less bullish.

Still, at least this straw in the wind is very bullish indeed for 2010.

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 113692

- Joined: Wed May 07, 2008 9:28 am

Re: US - 2010 Predictions

LenaHuat on 17 Dec 2009 wrote:IMHO, it's difficult to be optimistic abt 1Q2010. I've posted this so that I can track its expiry:-NEW YORK (CNNMoney.com) -- The House Wednesday overwhelmingly approved extending the filing deadline for unemployment benefits and the COBRA health coverage subsidy through the end of February.

Later, the House narrowly approved a $154 billion job creation package that would provide funding for infrastructure projects and keep teachers and emergency personnel on the job.

I've just read elsewhere that some investors think the S&P500 is already oversold. Gosh, the correction IMHO has just only begun.

Please be forewarned that you are reading a post by an otiose housewife.

**

** **

** @@

@@

**

** **

** @@

@@

-

LenaHuat - Big Boss

- Posts: 3066

- Joined: Thu May 08, 2008 9:35 am

Re: US - 2010 Predictions

So, will Ben's re-appointment be the catalyst to shoot it all the way down or another rebound?

One week to find out. (Jan 31, right?)

One week to find out. (Jan 31, right?)

1. Always wait for the setup. NO SETUP; NO TRADE

2. The trend will END but I don't know WHEN.

TA and Options stuffs on InvestIdeas:

The Ichimoku Thread | Option Strategies Thread | Japanese Candlesticks Thread

2. The trend will END but I don't know WHEN.

TA and Options stuffs on InvestIdeas:

The Ichimoku Thread | Option Strategies Thread | Japanese Candlesticks Thread

-

iam802 - Big Boss

- Posts: 5940

- Joined: Wed May 07, 2008 1:14 am

Who is online

Users browsing this forum: No registered users and 1 guest