CANSLIM & Momentum Investing 01 (May 08 - Jul 09)

Re: CANSLIM & Momentum Investing

that's right....ONeil's method is to be used in consolidated market environment....it is not very useful when when mkt is in a bear trend.... which is where we have been since 12 months ago....

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: CANSLIM & Momentum Investing

Went shopping 2day (it's a sure sign of stress according to modern day mentoring/career coaches  ) and bought O'Neill's book at 20% discount at a MPH store. The store's giving a 20% disc off all investment, finance and biz books.

) and bought O'Neill's book at 20% discount at a MPH store. The store's giving a 20% disc off all investment, finance and biz books.

This is only my second investment book after one abt WB Sure can make more money in the next cycle with this book

Sure can make more money in the next cycle with this book

This is only my second investment book after one abt WB

Please be forewarned that you are reading a post by an otiose housewife.

**

** **

** @@

@@

**

** **

** @@

@@

-

LenaHuat - Big Boss

- Posts: 3066

- Joined: Thu May 08, 2008 9:35 am

Re: CANSLIM & Momentum Investing

Quick! Swallow the book whole.. Absorb his ability. Make it part of your DNA!

-

RidingOnTop - Loafer

- Posts: 32

- Joined: Mon May 19, 2008 11:13 am

Re: CANSLIM & Momentum Investing

RidingOnTop wrote:Quick! Swallow the book whole.. Absorb his ability. Make it part of your DNA!

Erm... burn, mix in water and drink lah, traditional way. You last time study O- and A-Levels never do that meh?

- blid2def

- Permanent Loafer

- Posts: 2304

- Joined: Tue May 06, 2008 7:03 pm

Re: CANSLIM & Momentum Investing

have..... burnt a copy each for each subject for O and A levels... mixed with Red Bull and added raw egg...stirred it and left it in fridge ... i like'em cold....hahaha

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: CANSLIM & Momentum Investing

You mai sian lah... You like them cold? I think you put in freezer and let them turn to ice cubes right? You likes to suck (ice cubes), me knows, me knows!

- blid2def

- Permanent Loafer

- Posts: 2304

- Joined: Tue May 06, 2008 7:03 pm

Re: CANSLIM & Momentum Investing

oh...u like suck lollipops....hahahaha....big n hard ones ya?

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: CANSLIM & Momentum Investing

CANSLIM methodology pays strict attention to the market direction. I came across this article that mentioned about using market newsletters to time the market. This was written on March 11, 2003 after a horrendous bear market.

It tracks all kinds of newsletter. Mark mentioned that market bottoms when DIE HARD VALUE INVESTORS AND BUY AND HOLD INVESTORS decide that there is some merit to market timing.

Sure enough, the market notched a follow thro' on March 17, 2003 and it heralded in a unprecendented 4 year global bull market.

MARK HULBERT

Indicator shows final low may be near

By Mark Hulbert, CBS.MarketWatch.com

Last update: 12:01 a.m. EDT March 11, 2003

ANNANDALE, Va. (CBS.MW) -- Judging by a timing indicator I introduced more than a decade ago, we're closer than ever to the final low of the 2000-2003 bear market.

I dubbed this indicator the Market Timing Popularity Indicator, and it measures where advisers are between the extremes of buy-and-hold and market timing.

Historically, I noticed, buy-and-hold reaches its peak of popularity at market tops, just as market timing becomes most out of favor. The inverse tends to be the case at market bottoms.

And buy-and-hold has never been as out of favor as it is right now in the stock market, at least during the 23 years I have been tracking investment newsletters.

At the same time, advisers who formerly were hostile to market timing are now endorsing the practice.

mm comments - now I know Y when I previously posted in a value forum that market can be timed and should be timed that I got so many hostile comments and feedback

Consider the positive things that Sheldon Jacobs had to say about market timing in the most recent issue of his newsletter, the No-Load Fund Investor. During the 1990s Jacobs objected to being called a market timer, and criticized the Hulbert Financial Digest for tracking him on the assumption that he was one.

But in the March issue of his newsletter, which we received this past weekend, Jacobs wrote:

"To prosper in the coming years, new tactics will be required... If the secular bull market is indeed history, then forget buy-and-hold. The new basic strategy should be much like what worked between 1966 and 1982 [at the end of which the stock market was no higher than it had been at the beginning]. Investors should practice asset allocation, vary risk exposures to participate in cyclical trends, and even pursue market timing."

While Jacobs' change of heart is stark, it is not unique. I pick on him because, his inconsistency notwithstanding, he has a good long-term track record: His newsletter is in sixth place for risk-adjusted performance over the past 15 years among the 51 newsletters the HFD has tracked over this period.

The problem with inconsistency is that we more often than not engage in it at the wrong times. We are most tempted to second-guess our strategies at the very times we should instead be sticking to our guns.

Consider when investors should have been second-guessing their adherence to buy-and-hold. They would have been best served had they done so at the top of the bull market. It doesn't do them nearly as much good now, after a 50 percent drop in the stock market, to be told that market timing is something worth considering.

That's like closing the barn doors after the horses have left.

But, of course, at the top of the bull market most investors were not interested in market timing. They had "learned," throughout the previous bull market, that all corrections and dips are best treated as buying opportunities.

By the same token, market timers would be best served if they started second-guessing their philosophy at the bottom of bear markets. That's the best time to become a believer in buy-and-hold. But at such times, and now is one of them, very few are interested.

To be sure, the Market Timing Popularity Indicator cannot pinpoint exact tops or bottoms. But it is one piece of the puzzle that needs to be in place before the market can turn.

And from where I sit, reading 170 newsletters every day, it now seems firmly in place.

It tracks all kinds of newsletter. Mark mentioned that market bottoms when DIE HARD VALUE INVESTORS AND BUY AND HOLD INVESTORS decide that there is some merit to market timing.

Sure enough, the market notched a follow thro' on March 17, 2003 and it heralded in a unprecendented 4 year global bull market.

MARK HULBERT

Indicator shows final low may be near

By Mark Hulbert, CBS.MarketWatch.com

Last update: 12:01 a.m. EDT March 11, 2003

ANNANDALE, Va. (CBS.MW) -- Judging by a timing indicator I introduced more than a decade ago, we're closer than ever to the final low of the 2000-2003 bear market.

I dubbed this indicator the Market Timing Popularity Indicator, and it measures where advisers are between the extremes of buy-and-hold and market timing.

Historically, I noticed, buy-and-hold reaches its peak of popularity at market tops, just as market timing becomes most out of favor. The inverse tends to be the case at market bottoms.

And buy-and-hold has never been as out of favor as it is right now in the stock market, at least during the 23 years I have been tracking investment newsletters.

At the same time, advisers who formerly were hostile to market timing are now endorsing the practice.

mm comments - now I know Y when I previously posted in a value forum that market can be timed and should be timed that I got so many hostile comments and feedback

Consider the positive things that Sheldon Jacobs had to say about market timing in the most recent issue of his newsletter, the No-Load Fund Investor. During the 1990s Jacobs objected to being called a market timer, and criticized the Hulbert Financial Digest for tracking him on the assumption that he was one.

But in the March issue of his newsletter, which we received this past weekend, Jacobs wrote:

"To prosper in the coming years, new tactics will be required... If the secular bull market is indeed history, then forget buy-and-hold. The new basic strategy should be much like what worked between 1966 and 1982 [at the end of which the stock market was no higher than it had been at the beginning]. Investors should practice asset allocation, vary risk exposures to participate in cyclical trends, and even pursue market timing."

While Jacobs' change of heart is stark, it is not unique. I pick on him because, his inconsistency notwithstanding, he has a good long-term track record: His newsletter is in sixth place for risk-adjusted performance over the past 15 years among the 51 newsletters the HFD has tracked over this period.

The problem with inconsistency is that we more often than not engage in it at the wrong times. We are most tempted to second-guess our strategies at the very times we should instead be sticking to our guns.

Consider when investors should have been second-guessing their adherence to buy-and-hold. They would have been best served had they done so at the top of the bull market. It doesn't do them nearly as much good now, after a 50 percent drop in the stock market, to be told that market timing is something worth considering.

That's like closing the barn doors after the horses have left.

But, of course, at the top of the bull market most investors were not interested in market timing. They had "learned," throughout the previous bull market, that all corrections and dips are best treated as buying opportunities.

By the same token, market timers would be best served if they started second-guessing their philosophy at the bottom of bear markets. That's the best time to become a believer in buy-and-hold. But at such times, and now is one of them, very few are interested.

To be sure, the Market Timing Popularity Indicator cannot pinpoint exact tops or bottoms. But it is one piece of the puzzle that needs to be in place before the market can turn.

And from where I sit, reading 170 newsletters every day, it now seems firmly in place.

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: CANSLIM & Momentum Investing

millionairemind wrote:It tracks all kinds of newsletter. Mark mentioned that market bottoms when DIE HARD VALUE INVESTORS AND BUY AND HOLD INVESTORS decide that there is some merit to market timing.

Thanks for the post. I wonder what do value investors do when they decide to do some marketing timing, that creates the market bottom? Does it bottom because they finally decide to sell whatever they have left? (planning to buy back on uptrend later)

millionairemind wrote:Historically, I noticed, buy-and-hold reaches its peak of popularity at market tops, just as market timing becomes most out of favor. The inverse tends to be the case at market bottoms.

Doing the reverse would be wiser ya?

-

RidingOnTop - Loafer

- Posts: 32

- Joined: Mon May 19, 2008 11:13 am

Re: CANSLIM & Momentum Investing

It has been some time since I last posted in this thread.

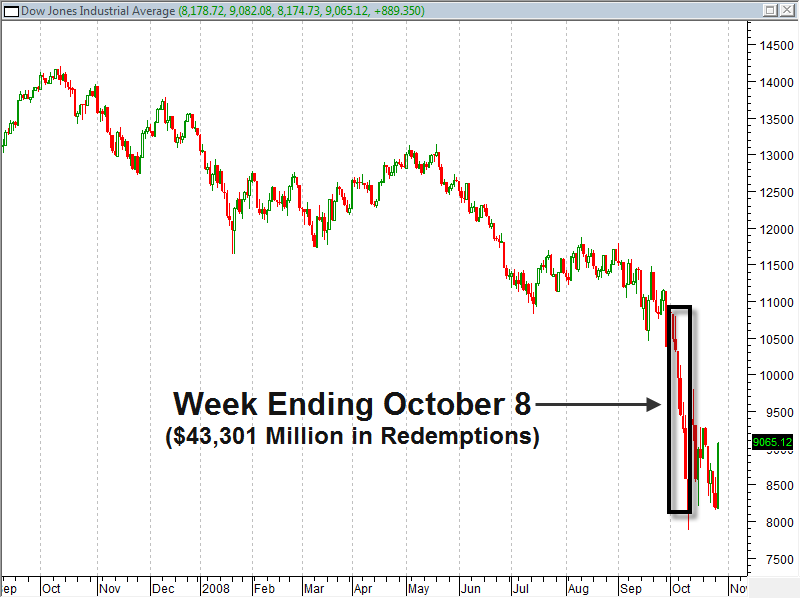

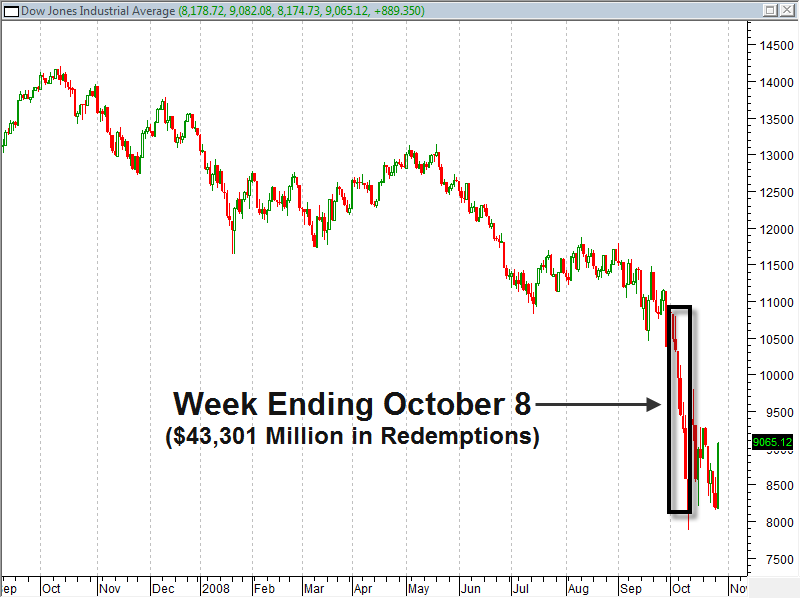

The I part of CANSLIM deals with Institutional investors. They can be pension funds, mutual funds or hedge funds. They sell for whatever reason you can think of - fund redemptions, lock in profits etc..

It does not matter Y they sell, it matters that we know they are selling thro' the market's price/volume action and we should sell early too. If not, we will ALL GET CRUSHED by the incoming train..

Equity Mutual Fund Redemptions Have Been Increasing

Redemptions have been increasing at faster and faster rates during the past few weeks and months. According to TrimTabs Investment Research, equity mutual funds have seen the following outflows of capital:

- During the week ending August 6 $2,987 million

- During the week ending August 13 $3,932 million

- During the week ending August 20 $5,135 million

- During the week ending August 27 $511 million

- During the week ending September 3 $4,790 million

- During the week ending September 10 $11,926 million

- During the week ending September 17 $17,852 million

- During the week ending September 24 $6,327 million

- During the week ending October 1 $7,159 million

- During the week ending October 8 $43,301 million

- During the week ending October 15 $13,937 million

- During the week ending October 22 $6,470 million

To see the impact the increase in redemptions has had on stock prices—especially the week ending October 8—take a look at the daily chart of the Dow Jones Industrial Average below.

That is the reason Y we must watch the market price/volume action closely to know if it is time for us to leave the market.

The I part of CANSLIM deals with Institutional investors. They can be pension funds, mutual funds or hedge funds. They sell for whatever reason you can think of - fund redemptions, lock in profits etc..

It does not matter Y they sell, it matters that we know they are selling thro' the market's price/volume action and we should sell early too. If not, we will ALL GET CRUSHED by the incoming train..

Equity Mutual Fund Redemptions Have Been Increasing

Redemptions have been increasing at faster and faster rates during the past few weeks and months. According to TrimTabs Investment Research, equity mutual funds have seen the following outflows of capital:

- During the week ending August 6 $2,987 million

- During the week ending August 13 $3,932 million

- During the week ending August 20 $5,135 million

- During the week ending August 27 $511 million

- During the week ending September 3 $4,790 million

- During the week ending September 10 $11,926 million

- During the week ending September 17 $17,852 million

- During the week ending September 24 $6,327 million

- During the week ending October 1 $7,159 million

- During the week ending October 8 $43,301 million

- During the week ending October 15 $13,937 million

- During the week ending October 22 $6,470 million

To see the impact the increase in redemptions has had on stock prices—especially the week ending October 8—take a look at the daily chart of the Dow Jones Industrial Average below.

That is the reason Y we must watch the market price/volume action closely to know if it is time for us to leave the market.

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Return to Other Investment Instruments & Ideas

Who is online

Users browsing this forum: No registered users and 9 guests