Hi MM,

Yes, you are absolutely right.

In the absence of a strong stock-specific catalyst, it is better to trade with the trend.

The difficulty comes when you find a strong stock specific catalyst, then you have to make a hard choice..

I will normally still bet but control risk thru a Stop-Loss and Position Sizing.

Take care,

Winston

Investment Myths Busted

Re: Investment Myths Busted

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 113050

- Joined: Wed May 07, 2008 9:28 am

Re: Investment Myths Busted

La pap,

Thanks for the charts.. you did some good work..

One point of discussion I would like to bring forward - the assumption that market always comes back up the longer you hold.. that is survivorship bias...

Your point about holding STI over a period of 20years for CAGR of 7.5% may sound appealing if taken on the surface, a better measure would be to use dollar cost averaging and invest at the end of every month and see if it still makes sense....

That might be a better way to slice and dice the data so as to be more objective.

I will try to put something together for the US indices when I get a chance...

Thanks for participating in this thread....

Cheers,

mm

Thanks for the charts.. you did some good work..

One point of discussion I would like to bring forward - the assumption that market always comes back up the longer you hold.. that is survivorship bias...

Your point about holding STI over a period of 20years for CAGR of 7.5% may sound appealing if taken on the surface, a better measure would be to use dollar cost averaging and invest at the end of every month and see if it still makes sense....

That might be a better way to slice and dice the data so as to be more objective.

I will try to put something together for the US indices when I get a chance...

Thanks for participating in this thread....

Cheers,

mm

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: Investment Myths Busted

MM,

Hmm, i thought survivorship bias is when we say that market always rebound, but not taking into account some companies that had fallen out of market? Unless we're investing into individual companies, survivorship bias will work for us (not against) when we invest in index or etf, since ultimately we only invest in an evolving portfolio that only includes the fittest (i assume that those who survive are the fittest) companies.

My article is full of flaws. The one you pointed out is one of them. I only show one method of investing - which is to buy on the 1st jan and divest on the 31st-dec over a period of years. This shows nothing unless one offers another method of investing. Do you need the STI data - I think I still have it - so you can show us the dollar cost averaging? Not sure how to calculate that.

Hmm, i thought survivorship bias is when we say that market always rebound, but not taking into account some companies that had fallen out of market? Unless we're investing into individual companies, survivorship bias will work for us (not against) when we invest in index or etf, since ultimately we only invest in an evolving portfolio that only includes the fittest (i assume that those who survive are the fittest) companies.

My article is full of flaws. The one you pointed out is one of them. I only show one method of investing - which is to buy on the 1st jan and divest on the 31st-dec over a period of years. This shows nothing unless one offers another method of investing. Do you need the STI data - I think I still have it - so you can show us the dollar cost averaging? Not sure how to calculate that.

An investment operation is one which, upon thorough analysis promises safety of principal and an adequate return - Benjamin Graham

-

la papillion - Boss' Left Hand Person

- Posts: 598

- Joined: Fri May 16, 2008 2:10 pm

Re: Investment Myths Busted

La Pap,

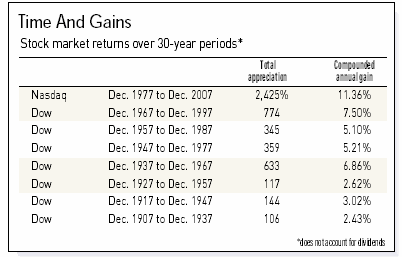

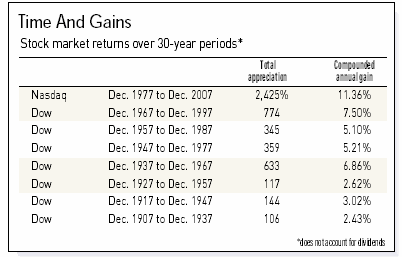

I have some data back out to 1930s from the US that shows that not all 30year cycles are created equal... be careful about the buy and hold mantra..

This is of course hindsight bias... the problem is that we never know which 30 year cycle we are in..

Once I have time to compile my tots for posting, I would let you and others to critique it cos' at times I can be quite unbalanced in my views..

Cheers,

mm

I have some data back out to 1930s from the US that shows that not all 30year cycles are created equal... be careful about the buy and hold mantra..

This is of course hindsight bias... the problem is that we never know which 30 year cycle we are in..

Once I have time to compile my tots for posting, I would let you and others to critique it cos' at times I can be quite unbalanced in my views..

Cheers,

mm

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: Investment Myths Busted

Thks mm, I'll wait for your thoughts

An investment operation is one which, upon thorough analysis promises safety of principal and an adequate return - Benjamin Graham

-

la papillion - Boss' Left Hand Person

- Posts: 598

- Joined: Fri May 16, 2008 2:10 pm

Re: Investment Myths Busted

Investment Myths

9. The unit trust managers know more than you (ya right )

11. Dollar-cost averaging boosts returns

12. Value and equity income funds will protect you in a downturn.

Dollar Cost Averaging is the perfect disguise to ask you to part with your hard earned money every single month... Nothing wrong with that.. except that don't expect it to boost your returns! So much so for staying with the market thro' thick and thin...

FundSupermart created 5 portfolios back in 2002. These 5 portfolios were constructed for the conservative, moderately conservative, balanced, semi-aggressive and aggressive.

https://secure.fundsupermart.com/main/i ... tfolio.tpl

According to the website:

These are our 5 recommended portfolios. These portfolio recommendations are meant to serve as possible guidelines and do not take into account the financial situation, time horizon, existing portfolio and risk profile of an individual investor. It is the investor's responsibility and discretion to decide if these funds are suitable for him or her. If in doubt, please seek professional advice. The initial portfolios were started on Nov 20, 2002, with $20,000. Monthly, $500 will be added to the portfolio as part of a regular savings plan. From August 2004, the monthly investment amount was changed to $1,000. The Fundsupermart Research team will be actively managing these portfolios through periodic re-balancing and through the changing of the component funds if necessary.

The scary thing is 4 out of 5 porfolios are losing money after 6 years... yes.. even after one of the strongest bull market from 2003-2007, they are net negative. The remaining +ve one is only <2%+ve.

Look at the DBS Shenton income fund... still -ve after 6 years!!! I got a friend who invested all thro' 6 years and was cursing it!

Be careful who in the fund industry is trying to hoodwink the public into believing the always quoted mantra - invest for the long term and dollar cost averaging....

9. The unit trust managers know more than you (ya right )

11. Dollar-cost averaging boosts returns

12. Value and equity income funds will protect you in a downturn.

Dollar Cost Averaging is the perfect disguise to ask you to part with your hard earned money every single month... Nothing wrong with that.. except that don't expect it to boost your returns! So much so for staying with the market thro' thick and thin...

FundSupermart created 5 portfolios back in 2002. These 5 portfolios were constructed for the conservative, moderately conservative, balanced, semi-aggressive and aggressive.

https://secure.fundsupermart.com/main/i ... tfolio.tpl

According to the website:

These are our 5 recommended portfolios. These portfolio recommendations are meant to serve as possible guidelines and do not take into account the financial situation, time horizon, existing portfolio and risk profile of an individual investor. It is the investor's responsibility and discretion to decide if these funds are suitable for him or her. If in doubt, please seek professional advice. The initial portfolios were started on Nov 20, 2002, with $20,000. Monthly, $500 will be added to the portfolio as part of a regular savings plan. From August 2004, the monthly investment amount was changed to $1,000. The Fundsupermart Research team will be actively managing these portfolios through periodic re-balancing and through the changing of the component funds if necessary.

The scary thing is 4 out of 5 porfolios are losing money after 6 years... yes.. even after one of the strongest bull market from 2003-2007, they are net negative. The remaining +ve one is only <2%+ve.

Look at the DBS Shenton income fund... still -ve after 6 years!!! I got a friend who invested all thro' 6 years and was cursing it!

Be careful who in the fund industry is trying to hoodwink the public into believing the always quoted mantra - invest for the long term and dollar cost averaging....

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: Investment Myths Busted

I have a friend who practises DCA for the last 2-3 years with a basket of about 6-8 unit trusts. Problem is that the losers outnumber the winners' gains and in the end, after fees, it's still net negative. So I really don't believe in DCA, I believe in picking the right companies and buying them at a discount to intrinsic value !

Please visit my value investing blog at http://sgmusicwhiz.blogspot.com

-

Musicwhiz - Boss' Right Hand Person

- Posts: 1239

- Joined: Sat May 17, 2008 2:02 am

Re: Investment Myths Busted

On DBS Shenton Income fund, isn't that the one that has great performance by the previous team about 2-3 years back. I remember they have double digit return then.

The whole (or almost) left DBS to start their own fund...

I remember DBS coming out to say... it is the process..not the people that is important.

My opinion: at least for this instant (DBS case), if the team leave, as a client one should also reduce the holding there.

The whole (or almost) left DBS to start their own fund...

I remember DBS coming out to say... it is the process..not the people that is important.

My opinion: at least for this instant (DBS case), if the team leave, as a client one should also reduce the holding there.

1. Always wait for the setup. NO SETUP; NO TRADE

2. The trend will END but I don't know WHEN.

TA and Options stuffs on InvestIdeas:

The Ichimoku Thread | Option Strategies Thread | Japanese Candlesticks Thread

2. The trend will END but I don't know WHEN.

TA and Options stuffs on InvestIdeas:

The Ichimoku Thread | Option Strategies Thread | Japanese Candlesticks Thread

-

iam802 - Big Boss

- Posts: 5940

- Joined: Wed May 07, 2008 1:14 am

Re: Investment Myths Busted

DCA should work with STI ETF. PTN, STI ETF has an yield of ~5% based on final dividend alone (XD already). IMO, CPF should be invested into this.

-

cif5000 - Foreman

- Posts: 271

- Joined: Wed May 14, 2008 7:04 pm

Re: Investment Myths Busted

La Pap - I finally got some free time this morning to think about how to bust some of the investment myths that I listed and that the FUN industry regularly quotes to hookwink the public.

If anyone is from the FUN industry and think my writing is rubbish (often am lah.. ), do feel free to counter me so that we can have a good discussion going on for all to benefit.

), do feel free to counter me so that we can have a good discussion going on for all to benefit.

Remember, nobody is more interested in growing your money than you are...

Additional Investment Myths busted.

3. Buy and hold, the market always comes back up (the mkt might be, but your stocks most likely will not )

5. Invest for the long term.. you will come out ahead. This one is similar to Stocks always rise in the long term. Don't try and time the market; what you need is time IN the market ! Just buy and hold

10. You can safely trust the stock market to outperform over 3 decades.

12. Value and equity income funds will protect you in a downturn.

Newly added The mkt on average returns 10% a year

The mkt on average returns 10% a year

I am sure everyone has heard about the 10% average returns of the stock mkt??? Roughly about 7-8% return for index plus 3% for dividends?

As our La Pap has also pointed out, our STI averaged 7.5% CAGR over 20 years.

However, one BIG FLAW in this argument is that the FUN industry DOES NOT TELL YOU what is the time horizon when the mkt went up on average 10% a year....

We all have roughly about 30years of investing time horizon before we retire... say one starts work at 25.. in the first 5 years, one will make mistakes... so by the time we hit 30, we will be pretty good (I hope). So we can invest, hopefully for 30years that by the time we hit 60, we have a sizeable egg nest...

That is where the FUN industry will come with their charts and BS telling you if you do DCA, based on previous data, you should have such a such a retirement amount kind of BS...what they don't tell you is... which 30year cycle we could be in.. cos' not all 30year cycles are created equally.

Do you know what contributed to the long term bull market in the 80s and 90s??? IMO, the following are contributing factors that changed the investment landscape.

1. The rapid rise in productivity due to computers, resulting in higher wages which could be invested

2. Rapid globalization driving corporate profits higher than ever before.

2. The liberalization of 401K plans as well as IRA in the US to be invested in the stock mkts worldwide

3. The baby boomers for once taking financial matters and retirement seriously.

Do remember that now the baby boomers in the US are starting to retire... without money to push the market even higher... do you think we will see a repeat of 10% average returns a year over the next 30 years???

However, whether this will be repeated in the next 30 years remains to be seen.

Buy an index fund, forget about it and let the long-term average return for stocks reward your patience — or so the thinking goes. [/b]

People who assume the average return is theirs for the taking could be disappointed.

First, there’s no guarantee that the U.S. indexes will repeat the same performance over the long-term. You can make an argument that American know-how and technological leadership will energize the markets in the coming decades.

You also could argue that ignorance about capitalism among politicians, educators and the electorate will only hurt the economy.

Second, if an individual invests passively for about 30 years, in the belief that the market will deliver its average long-term return, that individual doesn’t necessarily have the odds or history on their side. A 30-year period may include a protracted bear market. It isn’t easy to hit a big-picture average by taking a portion of the whole. Flip a coin long enough, and you will get near a 50-50 outcome. Flip a coin for a shorter period and the results could be atypical. The same is true in investing. Take for example an individual who invested from Dec. 31, 1907, to Dec. 31, 1937. This investor lived through a bull market and a crash. For those 30 years, the Dow appreciated 106%, or 2.43% compounded annually, not counting dividends.

Compare that with the performance of the Nasdaq from Dec. 30, 1977, to Dec. 31, 2007. The Nasdaq grew 2,425% or about 11% annually over those 30 years.

Still not convinced???

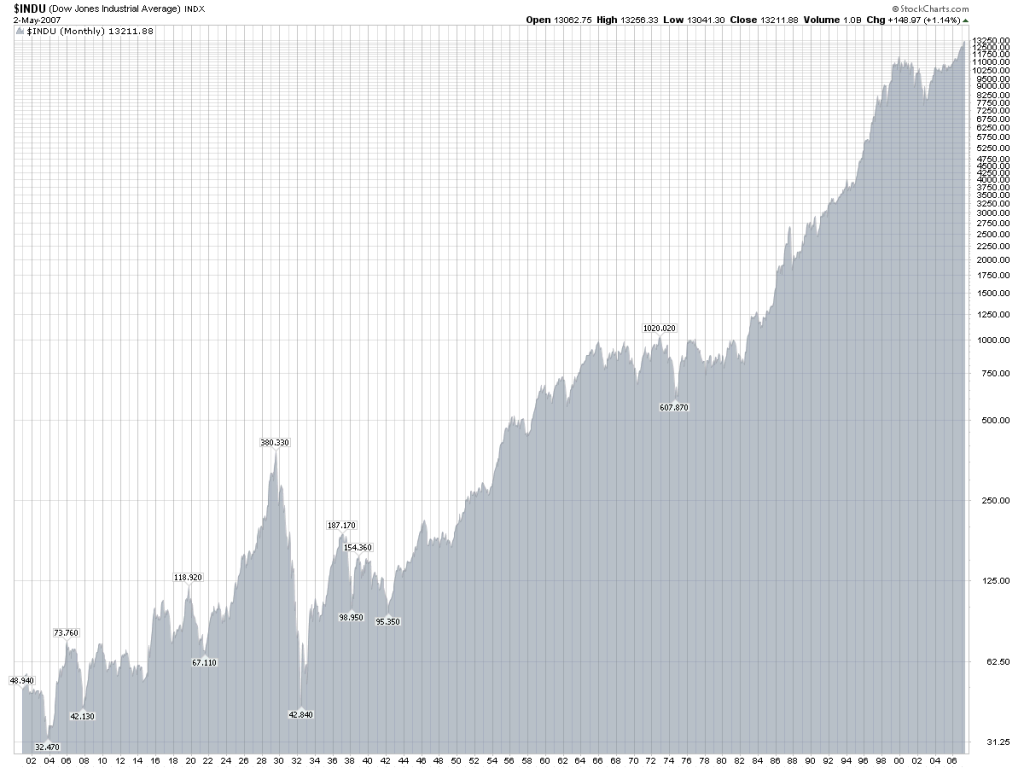

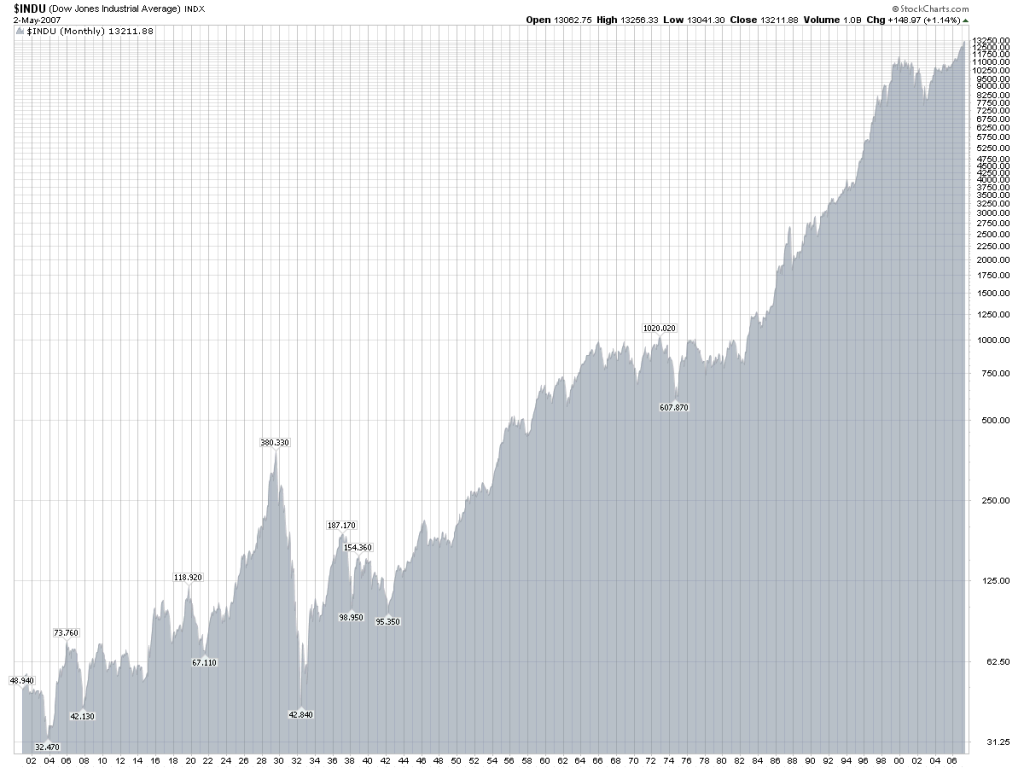

Ignoring dividends, if you had bought the Dow Jones index in 1965/66, do you know how long you would have had to wait to get your money back? Nearly seventeen years! That's right. The Dow first touched 1,000 points in January 1966 and then fell back. It never got back to 1,000 points until October 1982.

If you had bought near the top in 1929, do you know how long you would have had to wait for stock prices to get back to pre-crash levels? Twenty-five years! Yep, it was 1954 before the Dow put in a new high.

Apparently in the previous century there was a 43-year period during which Wall Street failed to reach a new peak.

More recently, in Australia, if you bought shares before the October 1987 correction, you would have had to hold them for a whole decade before they reached their pre-crash level again (apart from one fleeting touch in February 1994).

If you bought the Japanese Nikkei index before its peak in December 1989, you would still be down 50%, seventeen years later!

Wall Street's NASDAQ index is still about half what it was more than 7 years ago. How about those poor souls who religiously put money in the Nikkei from 20,000 to 40,000... after almost 20 years.. the Nikkei is currently still at 13,000!!!!

If words cannot convince you... how about a chart??

Now, just to highlight the part where the DOW went NOWHERE...

Be VERY CAREFUL who in the FUN industry is trying to hoodwink you into believing that the mkt averages 10% return a year... Be sure you are in the correct 30years

If anyone is from the FUN industry and think my writing is rubbish (often am lah..

Remember, nobody is more interested in growing your money than you are...

Additional Investment Myths busted.

3. Buy and hold, the market always comes back up (the mkt might be, but your stocks most likely will not )

5. Invest for the long term.. you will come out ahead. This one is similar to Stocks always rise in the long term. Don't try and time the market; what you need is time IN the market ! Just buy and hold

10. You can safely trust the stock market to outperform over 3 decades.

12. Value and equity income funds will protect you in a downturn.

Newly added

I am sure everyone has heard about the 10% average returns of the stock mkt??? Roughly about 7-8% return for index plus 3% for dividends?

As our La Pap has also pointed out, our STI averaged 7.5% CAGR over 20 years.

However, one BIG FLAW in this argument is that the FUN industry DOES NOT TELL YOU what is the time horizon when the mkt went up on average 10% a year....

We all have roughly about 30years of investing time horizon before we retire... say one starts work at 25.. in the first 5 years, one will make mistakes... so by the time we hit 30, we will be pretty good (I hope). So we can invest, hopefully for 30years that by the time we hit 60, we have a sizeable egg nest...

That is where the FUN industry will come with their charts and BS telling you if you do DCA, based on previous data, you should have such a such a retirement amount kind of BS...what they don't tell you is... which 30year cycle we could be in.. cos' not all 30year cycles are created equally.

Do you know what contributed to the long term bull market in the 80s and 90s??? IMO, the following are contributing factors that changed the investment landscape.

1. The rapid rise in productivity due to computers, resulting in higher wages which could be invested

2. Rapid globalization driving corporate profits higher than ever before.

2. The liberalization of 401K plans as well as IRA in the US to be invested in the stock mkts worldwide

3. The baby boomers for once taking financial matters and retirement seriously.

Do remember that now the baby boomers in the US are starting to retire... without money to push the market even higher... do you think we will see a repeat of 10% average returns a year over the next 30 years???

However, whether this will be repeated in the next 30 years remains to be seen.

Buy an index fund, forget about it and let the long-term average return for stocks reward your patience — or so the thinking goes. [/b]

People who assume the average return is theirs for the taking could be disappointed.

First, there’s no guarantee that the U.S. indexes will repeat the same performance over the long-term. You can make an argument that American know-how and technological leadership will energize the markets in the coming decades.

You also could argue that ignorance about capitalism among politicians, educators and the electorate will only hurt the economy.

Second, if an individual invests passively for about 30 years, in the belief that the market will deliver its average long-term return, that individual doesn’t necessarily have the odds or history on their side. A 30-year period may include a protracted bear market. It isn’t easy to hit a big-picture average by taking a portion of the whole. Flip a coin long enough, and you will get near a 50-50 outcome. Flip a coin for a shorter period and the results could be atypical. The same is true in investing. Take for example an individual who invested from Dec. 31, 1907, to Dec. 31, 1937. This investor lived through a bull market and a crash. For those 30 years, the Dow appreciated 106%, or 2.43% compounded annually, not counting dividends.

Compare that with the performance of the Nasdaq from Dec. 30, 1977, to Dec. 31, 2007. The Nasdaq grew 2,425% or about 11% annually over those 30 years.

Still not convinced???

Ignoring dividends, if you had bought the Dow Jones index in 1965/66, do you know how long you would have had to wait to get your money back? Nearly seventeen years! That's right. The Dow first touched 1,000 points in January 1966 and then fell back. It never got back to 1,000 points until October 1982.

If you had bought near the top in 1929, do you know how long you would have had to wait for stock prices to get back to pre-crash levels? Twenty-five years! Yep, it was 1954 before the Dow put in a new high.

Apparently in the previous century there was a 43-year period during which Wall Street failed to reach a new peak.

More recently, in Australia, if you bought shares before the October 1987 correction, you would have had to hold them for a whole decade before they reached their pre-crash level again (apart from one fleeting touch in February 1994).

If you bought the Japanese Nikkei index before its peak in December 1989, you would still be down 50%, seventeen years later!

Wall Street's NASDAQ index is still about half what it was more than 7 years ago. How about those poor souls who religiously put money in the Nikkei from 20,000 to 40,000... after almost 20 years.. the Nikkei is currently still at 13,000!!!!

If words cannot convince you... how about a chart??

Now, just to highlight the part where the DOW went NOWHERE...

Be VERY CAREFUL who in the FUN industry is trying to hoodwink you into believing that the mkt averages 10% return a year... Be sure you are in the correct 30years

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Return to Other Investment Instruments & Ideas

Who is online

Users browsing this forum: No registered users and 5 guests