802 : kam sia for this response.

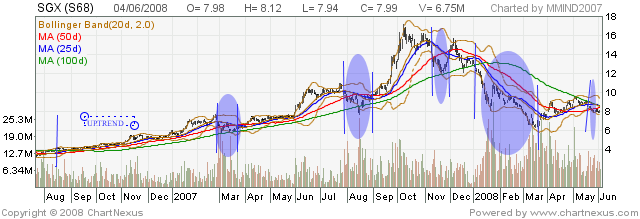

iam802 wrote:Unfortunately, we can't just look at SGX chart alone.

Why?

Because STI follows the US market. So, to see if one can buy SGX now (or tomorrow), look at DOW, NASDAQ.

i also duno, except that if this SGX chart by itself thru using O'Neil's method, cannot give direction to trade/invest, but have to be reliant on US indexes, then why look at it? wouldn't it be more meaningful then just to look at US based indexes, or SGX equivalent related sector, and then decide the next morning if SGX should be bought, sold or ignored?

If so, is O'Neil methodology applicable to some markets, some counters, some assets but not all?

I duno...

iam802 wrote:On price run up. When price runs up, investors/traders will be asking themselves, "Is it too high now? Will it crash ? Especially in current market conditions where no one knows about the subprime impact.

So, I am assuming the 'follow-thru' are market signals from the BB. If BB, is going in at this level, they can't run as fast as we do, because we are more nimble. So, the possibility of BB pulling out the very next day is relatively lower.

Does that make sense?

I think this is the first time I am thinking through this as well. So, maybe it does not make sense.

Maybe others can chip in and share their opinions.

thanks again boss...but sorry, i also duno....

in fact, i duno much about O'Neil's method that it puzzles me, despite MM having given me a private session before and having read several of ON's writings... what i dont know, bothers me and i am adamant in discovering more... I am certain this method works under certain circumstance...after all, a person called William O'Neil is prove...

ON gurus, please teach me... thanks.