My 2 cents:-

Investment Rules are Guiding Principles to me. They can be broken and should not be followed blindly. However, when you break a rule, know why you are breaking it and manage your risk accordingly..

Example: Market Direction

1) To a CANSLIM follower, Market Direction is of utmost importance

2) However, I do bet against the US Market Direction once in a while. When things get euphoric, I may buy a Put or when there is extreme fear, I may buy a call. My time horizon is extremely short ie. just a few hours.

3) I also bet against the US Market Direction, when I feel that the HSI & Shanghai is temporarily decoupling from the US Market, probably due to a local catalyst. Again, my time frame is very short.

4) Whenever there is a stock-specific catalyst, I will also bet against the US Market Direction as I feel that my stock specific- catalyst can overcome the headwinds from the US Market Direction, as long as there is not a full fledged crash.

5) I may also take a small position in a counter for Sensory Acuity purposes regardless of Market Direction. When I have a small position in a counter. I follow it better..

However, when I break any accepted "Investment Rules", I also control my risk by having a Stop Loss as well as a comfortable Position Size.

Investment Myths Busted

Re: Investment Myths Busted

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 113035

- Joined: Wed May 07, 2008 9:28 am

Re: Investment Myths Busted

W: v good model!

& u r keep'g an incredibly low profile, w/o interviews fr e media.

& u r keep'g an incredibly low profile, w/o interviews fr e media.

- helios

- Permanent Loafer

- Posts: 3527

- Joined: Wed May 07, 2008 8:30 am

Re: Investment Myths Busted

winston wrote:Hi MW,

We are here to challenge each other. As long as we do it in a civilized manner with no personal attacks, we should come out ahead at the end of the day.

Take care,

Winston

While I was kooning... so many good minds posting on this thread

That is the purpose of my posting... to challenge one another's assumption so that we can come out better...

I know there are better investors/traders out there... like Heng Heng, Winston Lao Da Ge, Kenny Da Ge and Lena who have seen alot in the market.

My idea for this thread is to offer alternative views... for any newbies out there...

We are only as free as our choices. How can we know market can be timed unless someone shows you the way?

Once you are offered a choice, you can choose.... we are only as free as our options..

I will be back in the days ahead to jumpstart this thread.

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Re: Investment Myths Busted

Musicwhiz wrote:Well mainly 1 and 2, as I do not believe in timing the markets. But I say this reluctantly, of course, as I know many people on the forum believe this to be consistently possible. Still, I stand by my view.

I think there is a difference between

A. looking at a chart of "Price vs. Time" and time your buying and selling

B. looking at a chart of "Value e.g. PER, PBR vs. Time" and time your buying and selling

As for point 6, investing is not about beating the market, so forget what Fund Managers say. It's about getting a consistent return on your investment.

Agree. Beating the market can mean market falls 30%, yours fall 20%, you beat/outperform the market by 10%. But there is no cause for celebration. Absolute return is desired.

"Random Walk Down Wall Street" -- haha this one I just started -- an interesting book. It is anti-"trading" and pro-"value investing".

Lai liao... lai liao...

- Apong

- Loafer

- Posts: 37

- Joined: Thu May 08, 2008 2:11 pm

Re: Investment Myths Busted

apong: hor say bo?

no wonder, i have never read this book.... ( i know, i very bad here...hahahaha)

no wonder, i have never read this book.... ( i know, i very bad here...hahahaha)

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: Investment Myths Busted

kennynah wrote:apong: hor say bo?

no wonder, i have never read this book.... ( i know, i very bad here...hahahaha)

kennynah... huat bo ?

I read books, read forums, seldom trade these days... [not experienced enough to trade volatile market -- especially with full time job, part time work, my children's tutor as well...]

When got free money, I go and buy some unit trusts e.g. Aberdeen's funds...

Very tempted to buy Breadtalk & Banyan Tree & Lyxor Taiwan as well....

Lai liao... lai liao...

- Apong

- Loafer

- Posts: 37

- Joined: Thu May 08, 2008 2:11 pm

Re: Investment Myths Busted

'pong : of cos, here at huatopedia, everyone everyday huat huat one...  wish u good luck !

wish u good luck !

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: Investment Myths Busted

Apong wrote:kennynah wrote:apong: hor say bo?

no wonder, i have never read this book.... ( i know, i very bad here...hahahaha)

kennynah... huat bo ?

I read books, read forums, seldom trade these days... [not experienced enough to trade volatile market -- especially with full time job, part time work, my children's tutor as well...]

When got free money, I go and buy some unit trusts e.g. Aberdeen's funds...

Very tempted to buy Breadtalk & Banyan Tree & Lyxor Taiwan as well....

When I first read that part highlighted in blue, I felt suspicious... hmm... like you're keeping your children's tutor busy... wahahaha... Then I read again... OH! You mean you are your children's tutor.

Hidden Content:

- blid2def

- Permanent Loafer

- Posts: 2304

- Joined: Tue May 06, 2008 7:03 pm

Re: Investment Myths Busted

Hidden Content:

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: Investment Myths Busted

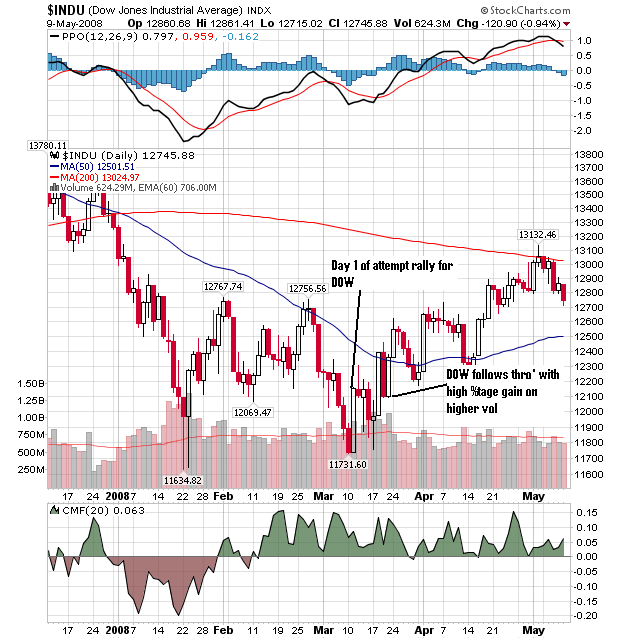

Myth No. 1. You cannot time the market

This one I have probably shown it in the US-Market Direction thread. However, I tot we put it here in its rightful place here so as to bust this myth.

I agree with HH that not everyone knows how to time the market.. but it can be learned... and that involves a lot of hard work. Losing money in the market is easy.. making money in the market is never easy (unless it is a super bull market). Not everyone can be an olympic swimmer.. but we can all learn to at least swim well enough not to sink

I am very sure MusicWhiz spends a lot of time tracking his companies... we all have to pay a price if we want to profit from the market.

If one is buying growth stocks that are traded in hundreds of lots a day, there is a very high chance that it will follow the market up and down as 3 out of 4 growth stocks follow the market's moves. If there is poor liquidity in the stock (say 20-30lots), then chances are this stock does not move too much.

To game the Asian market, all one needs is to follow the US market. When it goes into a correction, most Asian markets will follow suit.. in a matter of days.

The recent last 3 corrections started on Jan 7 2008, Nov 9 2007 and Jul 26 2007. If one goes back and check the charts, one will see that all our Asian indices and stocks tanked BIG time soon after that.

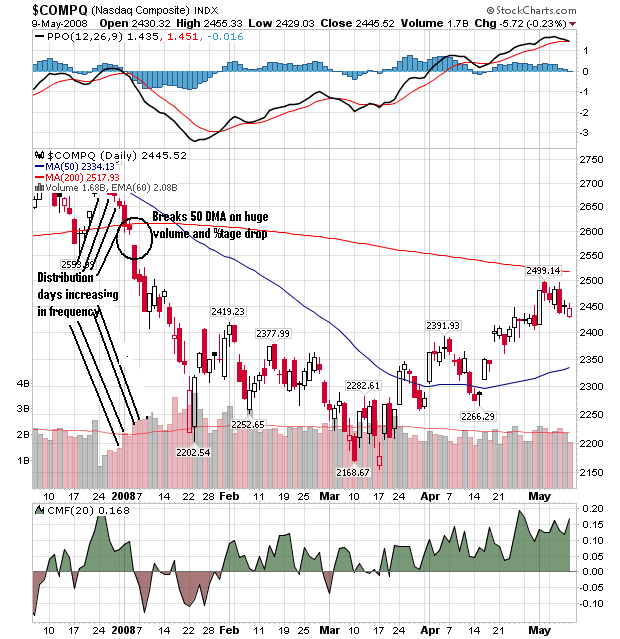

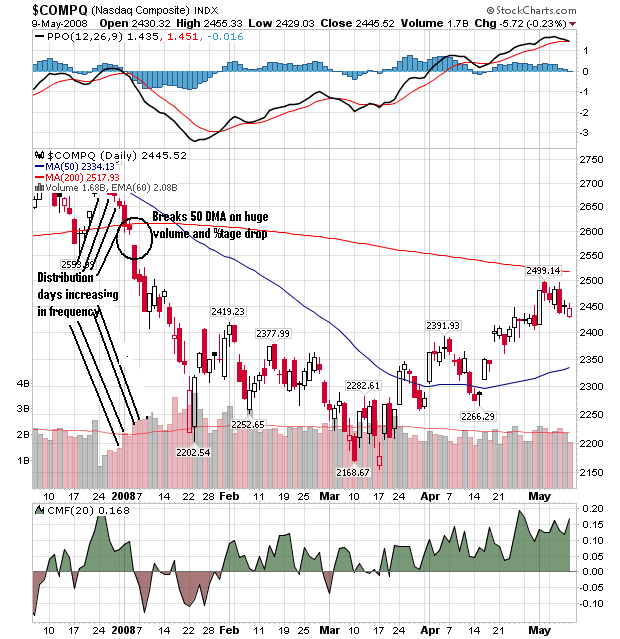

Definition of Distribution Day - When index closes down more than 0.2% on increase volume than the previous day..

Y is tracking distribution day important?? Distribution days tells us what the mutual funds are doing on the charts.. if they are selling, we should be too cos' they control 75% of the trading in the US. They can sell for a variety of reasons.. which is only known a couple of months later. Any time within a short period of a couple of weeks that you get 3-5 distribution days in short succession with a BIG break out of the 50DMA, a correction has just set in.

The selling in January was harsh and fast. It was only in March that it was evident that mutual funds were raising cash to fund redemptions.

If you are long side bias... it would be safer to close all your long positions until the next uptrend as most (not all) growth stocks follow the market trend.

Now for the follow thro' day that signifies a possible uptrend is in the making. Y possible? Cos' only about 70% of follow thro' days result in a uptrend lasting for months... the 30% fizzle out with a week to 2 weeks later.

A bit of definition - A follow-through is a gain of 1.7% or more by at least one of the major indexes on higher volume than the previous day, occurring on Day 4 onwards of the rally attempt.

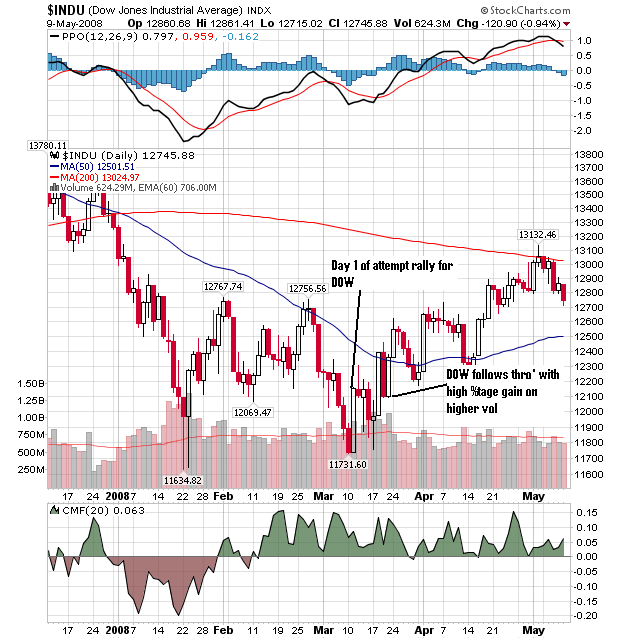

The last follow thro' day was on March 20 by the DOW. One needs to track NYSE, DOW, S&P and the Nasdaq for signs of follow thro' after the index stops falling and attempts to rally. A close higher than the previous day counts as Day 1 of attempt rally.

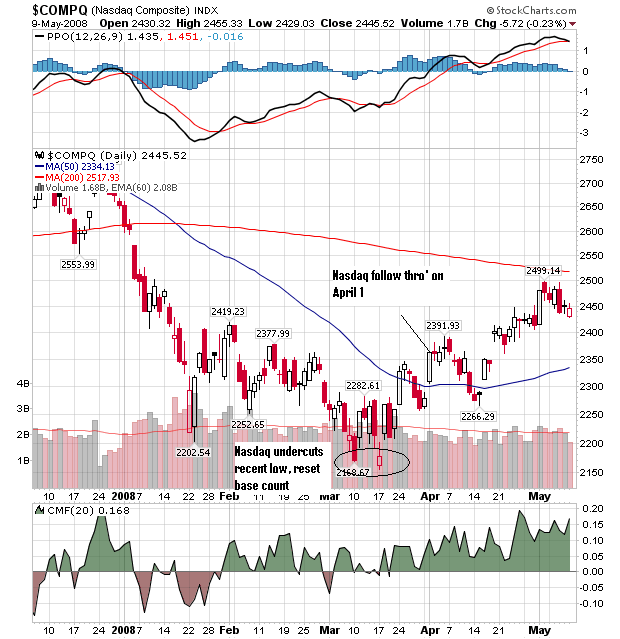

Anytime during the rally attempt, if it undercuts the recent low, the rally count resets back to zero again.

Prospective rally is intact as long as DAY 2/3 DOES not undercut Day 1's low. The most explosive rally occurs when the follow thro' day occurs in Day 4-10... why??? Even if Day 1/2/3 has positive gains, it could easily be short covering... It takes ALOT of money to move the index by a large amount beyond Day 4.

Here is the chart for the DOW. As you can see, the DOW followed thro' on Day 8 of attempt rally. The strongest rally I have seen all come from Day 4-10 of the rally attempt.

This follow thro' day is tested over more than 100 years of historical data. Please bear in mind that NOT ALL FOLLOW THRO' DAY results in a major uptrend BUT NO RALLY IN HISTORY HAS EVER STARTED WITHOUT A POWERFUL FOLLOW THRO' DAY.

This is accurate about 70% of the time... For me.. it is much better than blindly trading. Having the indices on an uptrend is like tail wind for your stock performance cos' most growth stocks will follow the market higher.

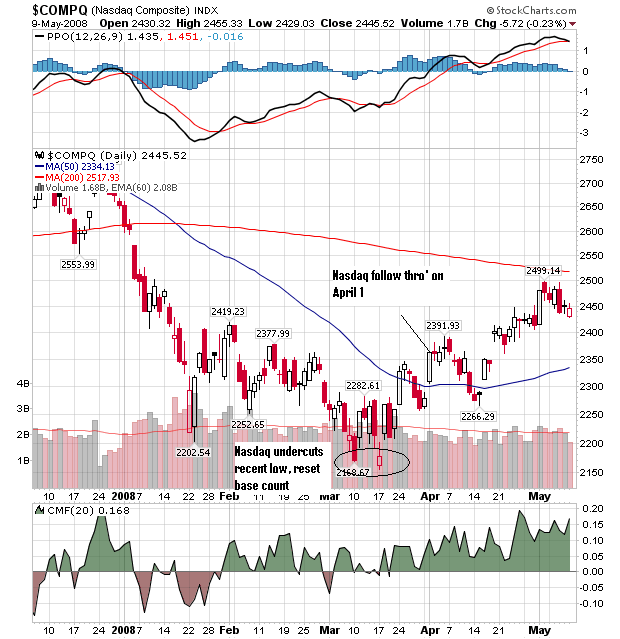

Y didn't the Nasdaq lead the follow thro' this time.. The Nasdaq undercut its recent low during the attempt while the DOW did not. So the base count was reset to zero again for the Nasdaq. The Nasdaq flashed a follow thro' on April 1.. together with the S&P 500.

After one of the index flashes a follow thro', you would also want the other market indices to flash their respective follow thro' day not too far away after the initial follow thro'. This signifies strength in the overall market and that the BIG funds are back in the market, busily buying up shares.

Right after follow thro' day, watch the market index for signs of weakness... namely major distribution day within 3 trading days thereafter... Historically, if that happens, this rally will be killed very very quickly.

This one I have probably shown it in the US-Market Direction thread. However, I tot we put it here in its rightful place here so as to bust this myth.

I agree with HH that not everyone knows how to time the market.. but it can be learned... and that involves a lot of hard work. Losing money in the market is easy.. making money in the market is never easy (unless it is a super bull market). Not everyone can be an olympic swimmer.. but we can all learn to at least swim well enough not to sink

I am very sure MusicWhiz spends a lot of time tracking his companies... we all have to pay a price if we want to profit from the market.

If one is buying growth stocks that are traded in hundreds of lots a day, there is a very high chance that it will follow the market up and down as 3 out of 4 growth stocks follow the market's moves. If there is poor liquidity in the stock (say 20-30lots), then chances are this stock does not move too much.

To game the Asian market, all one needs is to follow the US market. When it goes into a correction, most Asian markets will follow suit.. in a matter of days.

The recent last 3 corrections started on Jan 7 2008, Nov 9 2007 and Jul 26 2007. If one goes back and check the charts, one will see that all our Asian indices and stocks tanked BIG time soon after that.

Definition of Distribution Day - When index closes down more than 0.2% on increase volume than the previous day..

Y is tracking distribution day important?? Distribution days tells us what the mutual funds are doing on the charts.. if they are selling, we should be too cos' they control 75% of the trading in the US. They can sell for a variety of reasons.. which is only known a couple of months later. Any time within a short period of a couple of weeks that you get 3-5 distribution days in short succession with a BIG break out of the 50DMA, a correction has just set in.

The selling in January was harsh and fast. It was only in March that it was evident that mutual funds were raising cash to fund redemptions.

If you are long side bias... it would be safer to close all your long positions until the next uptrend as most (not all) growth stocks follow the market trend.

Now for the follow thro' day that signifies a possible uptrend is in the making. Y possible? Cos' only about 70% of follow thro' days result in a uptrend lasting for months... the 30% fizzle out with a week to 2 weeks later.

A bit of definition - A follow-through is a gain of 1.7% or more by at least one of the major indexes on higher volume than the previous day, occurring on Day 4 onwards of the rally attempt.

The last follow thro' day was on March 20 by the DOW. One needs to track NYSE, DOW, S&P and the Nasdaq for signs of follow thro' after the index stops falling and attempts to rally. A close higher than the previous day counts as Day 1 of attempt rally.

Anytime during the rally attempt, if it undercuts the recent low, the rally count resets back to zero again.

Prospective rally is intact as long as DAY 2/3 DOES not undercut Day 1's low. The most explosive rally occurs when the follow thro' day occurs in Day 4-10... why??? Even if Day 1/2/3 has positive gains, it could easily be short covering... It takes ALOT of money to move the index by a large amount beyond Day 4.

Here is the chart for the DOW. As you can see, the DOW followed thro' on Day 8 of attempt rally. The strongest rally I have seen all come from Day 4-10 of the rally attempt.

This follow thro' day is tested over more than 100 years of historical data. Please bear in mind that NOT ALL FOLLOW THRO' DAY results in a major uptrend BUT NO RALLY IN HISTORY HAS EVER STARTED WITHOUT A POWERFUL FOLLOW THRO' DAY.

This is accurate about 70% of the time... For me.. it is much better than blindly trading. Having the indices on an uptrend is like tail wind for your stock performance cos' most growth stocks will follow the market higher.

Y didn't the Nasdaq lead the follow thro' this time.. The Nasdaq undercut its recent low during the attempt while the DOW did not. So the base count was reset to zero again for the Nasdaq. The Nasdaq flashed a follow thro' on April 1.. together with the S&P 500.

After one of the index flashes a follow thro', you would also want the other market indices to flash their respective follow thro' day not too far away after the initial follow thro'. This signifies strength in the overall market and that the BIG funds are back in the market, busily buying up shares.

Right after follow thro' day, watch the market index for signs of weakness... namely major distribution day within 3 trading days thereafter... Historically, if that happens, this rally will be killed very very quickly.

"If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong" - Bernard Baruch

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

Disclaimer - The author may at times own some of the stocks mentioned in this forum. All discussions are NOT to be construed as buy/sell recommendations. Readers are advised to do their own research and analysis.

-

millionairemind - Big Boss

- Posts: 7776

- Joined: Wed May 07, 2008 8:50 am

- Location: The Matrix

Return to Other Investment Instruments & Ideas

Who is online

Users browsing this forum: No registered users and 5 guests