US - Subprime

Re: Subprime Issues

bottomed

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: Subprime Issues

Hi K,

How abt AIG's news? Seems like it posted $7.81 billion quarterly loss issit?

have fun,

fc

How abt AIG's news? Seems like it posted $7.81 billion quarterly loss issit?

have fun,

fc

- fclim

- Loafer

- Posts: 78

- Joined: Thu May 08, 2008 10:16 pm

Re: Subprime Issues

hi fc :

sorry for my ultra short response...too shag tonight..

i think "subprime" problem is no longer a big issue becos :

fiscal + monetary + fed lendings + special statues past by congress for mortgage insurers + many others... all culminate to solving the problem soon enough...

econ 101, demand and supply will find equilibirum for housing prices in time... this one, i can guarantee

sorry for my ultra short response...too shag tonight..

i think "subprime" problem is no longer a big issue becos :

fiscal + monetary + fed lendings + special statues past by congress for mortgage insurers + many others... all culminate to solving the problem soon enough...

econ 101, demand and supply will find equilibirum for housing prices in time... this one, i can guarantee

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: Subprime Issues

FBI cites escalating mortgage fraud problem

Tue May 13, 2008 By James Vicini

WASHINGTON (Reuters) - Mortgage fraud is an escalating problem in the United States, the FBI said on Tuesday in a report that cited the subprime lending crisis as a key contributing factor.

The FBI said it received 46,717 "suspicious activity reports" from financial institutions related to mortgage fraud last year, compared with 35,617 in fiscal 2006 and just 6,936 in fiscal 2003. The government's fiscal year begins on October 1.

The total dollar loss attributed to mortgage fraud is unknown. But 7 percent of the suspicious activity reports filed in 2007 indicated a specific dollar loss exceeding $813 million, the FBI said.

"The $813 million loss denoted in this report is just the tip of the iceberg, reflecting only a small percentage of financial damage suffered by victims of mortgage fraud," said Assistant FBI Director Kenneth Kaiser, who is in charge of the criminal investigative division.

"The FBI remains committed to working with our law enforcement, regulatory, and industry partners to unravel these complicated fraud schemes and bring their perpetrators to justice," he said in a statement released with the report that details mortgage fraud in 2007.

The report did not name any specific companies and summarized mortgage fraud data from government agencies, private analysts, Fannie Mae and other sources.

FBI Director Robert Mueller said last month that the bureau's investigation of potential fraud in the U.S. home mortgage industry now involves 19 companies.

He did not identify any of the companies targeted in the FBI's investigation, but said the law enforcement agency was focusing on accounting fraud, insider trading and deceptive sales practices.

In the report for 2007, the FBI said the subprime share of outstanding loans has more than doubled since 2003, putting a greater share of loans at higher risk of failure.

The high-interest, high-risk loans, which were designed for people with poor or limited credit histories, contributed to the 2.2 million foreclosures filed during 2007, up 75 percent from 2006, the report said.

It said mortgage fraud appeared to be most concentrated in the north-central region of the United States.

The top 10 mortgage fraud states for 2007 were Florida, Georgia, Michigan, California, Illinois, Ohio, Texas, New York, Colorado, and Minnesota.

Other states significantly affected by mortgage fraud included Arizona, Maryland, Utah, Nevada, Missouri, Indiana, Tennessee, Virginia, New Jersey, and Connecticut.

The report cited a number of the latest mortgage fraud schemes.

They include "builder-bailout" schemes, in which developers unload excess inventory through financial trickery, foreclosure rescue frauds that trick homeowners into signing over the deed to their house, seller-assistance scams that use false appraisals to sell homes and identity theft that leads to home equity credit lines being opened and drained.

The report is available on the FBI's website here

Tue May 13, 2008 By James Vicini

WASHINGTON (Reuters) - Mortgage fraud is an escalating problem in the United States, the FBI said on Tuesday in a report that cited the subprime lending crisis as a key contributing factor.

The FBI said it received 46,717 "suspicious activity reports" from financial institutions related to mortgage fraud last year, compared with 35,617 in fiscal 2006 and just 6,936 in fiscal 2003. The government's fiscal year begins on October 1.

The total dollar loss attributed to mortgage fraud is unknown. But 7 percent of the suspicious activity reports filed in 2007 indicated a specific dollar loss exceeding $813 million, the FBI said.

"The $813 million loss denoted in this report is just the tip of the iceberg, reflecting only a small percentage of financial damage suffered by victims of mortgage fraud," said Assistant FBI Director Kenneth Kaiser, who is in charge of the criminal investigative division.

"The FBI remains committed to working with our law enforcement, regulatory, and industry partners to unravel these complicated fraud schemes and bring their perpetrators to justice," he said in a statement released with the report that details mortgage fraud in 2007.

The report did not name any specific companies and summarized mortgage fraud data from government agencies, private analysts, Fannie Mae and other sources.

FBI Director Robert Mueller said last month that the bureau's investigation of potential fraud in the U.S. home mortgage industry now involves 19 companies.

He did not identify any of the companies targeted in the FBI's investigation, but said the law enforcement agency was focusing on accounting fraud, insider trading and deceptive sales practices.

In the report for 2007, the FBI said the subprime share of outstanding loans has more than doubled since 2003, putting a greater share of loans at higher risk of failure.

The high-interest, high-risk loans, which were designed for people with poor or limited credit histories, contributed to the 2.2 million foreclosures filed during 2007, up 75 percent from 2006, the report said.

It said mortgage fraud appeared to be most concentrated in the north-central region of the United States.

The top 10 mortgage fraud states for 2007 were Florida, Georgia, Michigan, California, Illinois, Ohio, Texas, New York, Colorado, and Minnesota.

Other states significantly affected by mortgage fraud included Arizona, Maryland, Utah, Nevada, Missouri, Indiana, Tennessee, Virginia, New Jersey, and Connecticut.

The report cited a number of the latest mortgage fraud schemes.

They include "builder-bailout" schemes, in which developers unload excess inventory through financial trickery, foreclosure rescue frauds that trick homeowners into signing over the deed to their house, seller-assistance scams that use false appraisals to sell homes and identity theft that leads to home equity credit lines being opened and drained.

The report is available on the FBI's website here

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 113035

- Joined: Wed May 07, 2008 9:28 am

Re: Subprime Issues

Bloomberg: Rubenstein says “enormous†bank losses unrecognized

“US and European banks and financial institutions have ‘enormous losses’ from bad loans they haven’t yet recognized and may have a harder time wooing sovereign-fund rescuers, Carlyle Group Chairman David Rubenstein said.

“‘Based on information I see,’ it will take at least a year before all losses are realized, and some financial institutions may fail, Rubenstein said.

“‘The sovereign wealth funds are not likely to jump into the fray again to bail out these institutions,’ Rubenstein said. ‘Many financial institutions aren’t going to be able to survive as independent institutions.’

“Rubenstein said sovereign wealth funds are becoming wary after losing $25 billion on their investments in struggling banks and securities firms worldwide.

“Rubenstein said today that the industry and broader economy aren’t likely to turn around until early next year. ‘The truth is, we’re in some kind of economic slowdown,’ Rubenstein said. ‘I don’t think it’s going to be over for quite a while.’

“He said the US slowdown doesn’t seem to be spreading to the rest of the world because the US economy makes up a smaller share of global economic activity than it has in the past, when recessions typically spread worldwide.â€

Source: Ryan J. Donmoyer and Alison Fitzgerald, Bloomberg, May 12, 2008.

“US and European banks and financial institutions have ‘enormous losses’ from bad loans they haven’t yet recognized and may have a harder time wooing sovereign-fund rescuers, Carlyle Group Chairman David Rubenstein said.

“‘Based on information I see,’ it will take at least a year before all losses are realized, and some financial institutions may fail, Rubenstein said.

“‘The sovereign wealth funds are not likely to jump into the fray again to bail out these institutions,’ Rubenstein said. ‘Many financial institutions aren’t going to be able to survive as independent institutions.’

“Rubenstein said sovereign wealth funds are becoming wary after losing $25 billion on their investments in struggling banks and securities firms worldwide.

“Rubenstein said today that the industry and broader economy aren’t likely to turn around until early next year. ‘The truth is, we’re in some kind of economic slowdown,’ Rubenstein said. ‘I don’t think it’s going to be over for quite a while.’

“He said the US slowdown doesn’t seem to be spreading to the rest of the world because the US economy makes up a smaller share of global economic activity than it has in the past, when recessions typically spread worldwide.â€

Source: Ryan J. Donmoyer and Alison Fitzgerald, Bloomberg, May 12, 2008.

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 113035

- Joined: Wed May 07, 2008 9:28 am

Re: Subprime Issues

Banks Hide $35 Billion in Writedowns From Income, Filings Show By Yalman Onaran

May 19 (Bloomberg) -- Banks and securities firms, reeling from record losses resulting from the collapse of the mortgage securities market, are failing to acknowledge in their income statements at least $35 billion of additional writedowns included in their balance sheets, regulatory filings show.

Citigroup Inc. subtracted $2 billion from equity for the declining value of home-loan bonds in its quarterly report to the Securities and Exchange Commission on May 2 without mentioning the deduction in the earnings statement or conference call with investors that followed. ING Groep NV placed 3.6 billion euros ($5.6 billion) of negative valuations in its capital account, while disclosing only an 80 million-euro depletion to income.

The balance-sheet adjustments are in addition to $344 billion of writedowns and credit losses already reported on the income statements of more than 100 banks. These companies have raised $263 billion from sovereign wealth funds, their own governments and public investors to shore up capital. The balance-sheet writedowns also reduce equity, which needs to be replenished. Adding the $35 billion leaves the banks with a $116 billion mountain of losses to climb.

``The smart people are the ones who've identified the problems, put them out there in full transparency, and addressed them by raising more capital,'' said Michael Holland, who oversees more than $4 billion as chairman of Holland & Co. in New York. ``There is still billions of dollars of crap out there that hasn't worked itself through the system. Banks need more capital to work that all out.''

Accounting Rules

Taking losses on a balance sheet instead of an income statement is acceptable under accounting rules, which make a distinction between so-called trading books and long-term investments. Changes in value on the trading side go straight to revenue. Changes in the value of bonds held for the long haul can be marked down on the equity line of a balance sheet, as long as the declines aren't considered permanent.

Banks that are more willing to acknowledge their balance- sheet writedowns, such as Amsterdam-based ING, say the valuations of assets will be reversed when markets recover. ING, the biggest Dutch financial-services company, said in its first-quarter earnings report last week that the drop in the value of bonds tied to home loans that are held to maturity is irrelevant as long as the underlying mortgages don't default.

With that logic, most of the writedowns on the income statements could be reversed if asset prices recover. While some declines in valuations may reverse, most of the losses are permanent impairments caused by surging defaults on U.S. mortgages, said Janet Tavakoli, author of ``Collateralized Debt Obligations & Structured Finance,'' published in 2004 by John Wiley & Sons Inc.

`Value Loss'

``Of course we can't tell how much of a bank's portfolio may actually be good stuff that will pay back at maturity,'' Tavakoli said. ``But there's tremendous value loss that's fundamental, not just due to credit market gyrations.''

Keeping those markdowns off income statements just delays the realization of the losses, according to Brad Hintz, a New York- based analyst at Sanford C. Bernstein & Co.

``The banks that have taken advantage of this accounting approach are going to have a price to pay later,'' said Hintz, the third-highest ranked securities analyst in an Institutional Investor magazine survey. ``You don't avoid the price. Those that have taken it all in their income statements will come out with clean balance sheets and move on.''

Reminiscent of Japan

Ignoring bad debt and postponing inevitable losses was one of the main reasons behind Japan's decade-long economic slump that began in the 1990s, said Boston University law professor Charles Whitehead.

Faced with new capital requirements and a weakened ability to meet them, Japanese banks deferred the recognition of their losses, aided by regulators who refrained from implementing the rules, Whitehead wrote in a 2006 paper published in the Michigan Journal of International Law.

``U.S. regulators may be tempted to go soft on banks too,'' said Whitehead, who teaches securities regulation, in an interview. ``The new capital rules already rely significantly on self-modeling by the banks. So if anything, the risks may be greater in the U.S. today than they were in Japan in the 1990s.''

The new bank-capital regime, known as Basel II, has gone into effect in some European countries and is being implemented in the U.S. and others starting this year. It allows financial institutions to use in-house risk models instead of just relying on external credit-worthiness ratings in calculating their risk- weighted capital requirements.

The largest U.S. securities firms have been under capital requirements shaped by Basel II since 2004.

Shareholders at Stake

Even if regulators are soft on banks and brokers when it comes to capital requirements, investors won't be, according to Samuel Hayes, professor emeritus at Harvard Business School in Boston.

The collapse in March of New York-based Bear Stearns Cos., once the fifth-largest U.S. securities firm, shows that fulfilling regulatory capital requirements isn't sufficient to survive, Hayes said. The SEC has said Bear Stearns was ``well-capitalized'' until the moment it faced bankruptcy as clients and creditors lost confidence and withdrew their money.

``They have to keep raising capital levels, there's no getting around that fact,'' Hayes said. ``Perception is so important here. If investors or creditors feel a bank doesn't have a strong capital cushion to face further writedowns, that could prove problematic.''

Balance-Sheet Items

A review of the balance sheets and regulatory filings of more than 50 banks showed that 20 of them chose to keep some subprime- related losses off their income statements. The marks were recorded instead on balance-sheet items labeled ``other comprehensive income'' or ``revaluation reserves.''

Seattle-based Washington Mutual Inc., which has taken $217 million of subprime-related writedowns against profits, kept a bigger amount on the other-comprehensive-income line of its balance sheet, which swung to a $782 million loss in the first quarter. Fortis, the Amsterdam and Brussels-based bank, put 990 million euros of losses in revaluation reserves, in addition to the 3.3 billion euros it reported on its income statement.

Merrill Lynch & Co. in New York, which has booked $31.7 billion from market markdowns in its income statements, is keeping another $5.3 billion of losses on its balance sheet as other comprehensive income. The revaluation reserve reduction of 740 million pounds ($1.4 billion) at London-based Lloyds TSB Group Plc is bigger than the 667 million pounds charged against profit.

Officials at Citigroup, Merrill Lynch, Washington Mutual and Fortis declined to comment. Lloyds TSB spokeswoman Kirsty Clay said none of the assets included in the available-for-sale reserves are considered to be ``permanently impaired.''

$100 Billion Hole

The writedowns aren't finished yet. London-based Fitch Ratings Ltd. expects as much as $110 billion in additional losses on subprime securities.

Declines in asset prices have spread beyond subprime though, affecting other mortgage bonds, securitized car and student loans, leveraged lending that backs private equity buyouts and credit derivatives. When all that is included, the IMF estimates that total losses from the U.S. subprime debacle will reach $1 trillion, of which $510 billion will be born by banks. That means some $130 billion in losses remains to be taken.

``The $100 billion hole between writedowns and capital raised so far needs to be filled,''[/b] said Michael Mayo, a New York-based analyst who tracks the financial-services industry at Deutsche Bank AG. ``If you don't fill that hole, with the 20-to-1 leverage existing on average out there, you need to de-lever $2 trillion of assets. You can do that or raise more capital.''

One way to increase capital has been to halt or slow down the pace of share buybacks. Companies often repurchase stock to offset dilution that occurs when shares are distributed to employees as part of their compensation.

Looking for Capital

Citigroup, the biggest U.S. bank by assets, JPMorgan Chase & Co., the third-largest bank, and Morgan Stanley, the No. 2 U.S. securities firm by market value, have suspended stock-buyback programs. All the companies are based in New York.

Outstanding stock increased 7 percent at Citigroup, 4.3 percent at Morgan Stanley, and 2 percent at JPMorgan during the past two quarters, according to regulatory filings. New York-based Lehman Brothers Holdings Inc., the fourth-biggest securities firm, has done the same without announcing a suspension of its repurchase program. Lehman shares in circulation rose 4.3 percent.

The first place banks and brokers went looking for capital was in the deep pockets of the Asian and Middle Eastern sovereign wealth funds, flush with cash from rising commodity prices. Then they reached out to public investors, who were offered hybrid securities with characteristics of both equity and debt, limiting their dilutive impact on common shares.

`It's Like Shampooing'

The sovereign funds, which bought shares at 20 percent above today's market prices, are probably not coming back soon, said Jeffrey Rosenberg, a New York-based managing director at Bank of America Corp., who was among the first analysts to warn clients about the mortgage crisis.

Banks can't keep selling hybrid bonds because ratings firms place limits on how much of their capital can be tied up in such securities. Rosenberg said the next round of equity-strengthening probably will be in the form of common stock.

``It's like shampooing: lather, rinse, repeat -- write down, raise capital, repeat,'' Rosenberg said. ``How long can they keep doing it? Shareholders are in for a long ride.''

May 19 (Bloomberg) -- Banks and securities firms, reeling from record losses resulting from the collapse of the mortgage securities market, are failing to acknowledge in their income statements at least $35 billion of additional writedowns included in their balance sheets, regulatory filings show.

Citigroup Inc. subtracted $2 billion from equity for the declining value of home-loan bonds in its quarterly report to the Securities and Exchange Commission on May 2 without mentioning the deduction in the earnings statement or conference call with investors that followed. ING Groep NV placed 3.6 billion euros ($5.6 billion) of negative valuations in its capital account, while disclosing only an 80 million-euro depletion to income.

The balance-sheet adjustments are in addition to $344 billion of writedowns and credit losses already reported on the income statements of more than 100 banks. These companies have raised $263 billion from sovereign wealth funds, their own governments and public investors to shore up capital. The balance-sheet writedowns also reduce equity, which needs to be replenished. Adding the $35 billion leaves the banks with a $116 billion mountain of losses to climb.

``The smart people are the ones who've identified the problems, put them out there in full transparency, and addressed them by raising more capital,'' said Michael Holland, who oversees more than $4 billion as chairman of Holland & Co. in New York. ``There is still billions of dollars of crap out there that hasn't worked itself through the system. Banks need more capital to work that all out.''

Accounting Rules

Taking losses on a balance sheet instead of an income statement is acceptable under accounting rules, which make a distinction between so-called trading books and long-term investments. Changes in value on the trading side go straight to revenue. Changes in the value of bonds held for the long haul can be marked down on the equity line of a balance sheet, as long as the declines aren't considered permanent.

Banks that are more willing to acknowledge their balance- sheet writedowns, such as Amsterdam-based ING, say the valuations of assets will be reversed when markets recover. ING, the biggest Dutch financial-services company, said in its first-quarter earnings report last week that the drop in the value of bonds tied to home loans that are held to maturity is irrelevant as long as the underlying mortgages don't default.

With that logic, most of the writedowns on the income statements could be reversed if asset prices recover. While some declines in valuations may reverse, most of the losses are permanent impairments caused by surging defaults on U.S. mortgages, said Janet Tavakoli, author of ``Collateralized Debt Obligations & Structured Finance,'' published in 2004 by John Wiley & Sons Inc.

`Value Loss'

``Of course we can't tell how much of a bank's portfolio may actually be good stuff that will pay back at maturity,'' Tavakoli said. ``But there's tremendous value loss that's fundamental, not just due to credit market gyrations.''

Keeping those markdowns off income statements just delays the realization of the losses, according to Brad Hintz, a New York- based analyst at Sanford C. Bernstein & Co.

``The banks that have taken advantage of this accounting approach are going to have a price to pay later,'' said Hintz, the third-highest ranked securities analyst in an Institutional Investor magazine survey. ``You don't avoid the price. Those that have taken it all in their income statements will come out with clean balance sheets and move on.''

Reminiscent of Japan

Ignoring bad debt and postponing inevitable losses was one of the main reasons behind Japan's decade-long economic slump that began in the 1990s, said Boston University law professor Charles Whitehead.

Faced with new capital requirements and a weakened ability to meet them, Japanese banks deferred the recognition of their losses, aided by regulators who refrained from implementing the rules, Whitehead wrote in a 2006 paper published in the Michigan Journal of International Law.

``U.S. regulators may be tempted to go soft on banks too,'' said Whitehead, who teaches securities regulation, in an interview. ``The new capital rules already rely significantly on self-modeling by the banks. So if anything, the risks may be greater in the U.S. today than they were in Japan in the 1990s.''

The new bank-capital regime, known as Basel II, has gone into effect in some European countries and is being implemented in the U.S. and others starting this year. It allows financial institutions to use in-house risk models instead of just relying on external credit-worthiness ratings in calculating their risk- weighted capital requirements.

The largest U.S. securities firms have been under capital requirements shaped by Basel II since 2004.

Shareholders at Stake

Even if regulators are soft on banks and brokers when it comes to capital requirements, investors won't be, according to Samuel Hayes, professor emeritus at Harvard Business School in Boston.

The collapse in March of New York-based Bear Stearns Cos., once the fifth-largest U.S. securities firm, shows that fulfilling regulatory capital requirements isn't sufficient to survive, Hayes said. The SEC has said Bear Stearns was ``well-capitalized'' until the moment it faced bankruptcy as clients and creditors lost confidence and withdrew their money.

``They have to keep raising capital levels, there's no getting around that fact,'' Hayes said. ``Perception is so important here. If investors or creditors feel a bank doesn't have a strong capital cushion to face further writedowns, that could prove problematic.''

Balance-Sheet Items

A review of the balance sheets and regulatory filings of more than 50 banks showed that 20 of them chose to keep some subprime- related losses off their income statements. The marks were recorded instead on balance-sheet items labeled ``other comprehensive income'' or ``revaluation reserves.''

Seattle-based Washington Mutual Inc., which has taken $217 million of subprime-related writedowns against profits, kept a bigger amount on the other-comprehensive-income line of its balance sheet, which swung to a $782 million loss in the first quarter. Fortis, the Amsterdam and Brussels-based bank, put 990 million euros of losses in revaluation reserves, in addition to the 3.3 billion euros it reported on its income statement.

Merrill Lynch & Co. in New York, which has booked $31.7 billion from market markdowns in its income statements, is keeping another $5.3 billion of losses on its balance sheet as other comprehensive income. The revaluation reserve reduction of 740 million pounds ($1.4 billion) at London-based Lloyds TSB Group Plc is bigger than the 667 million pounds charged against profit.

Officials at Citigroup, Merrill Lynch, Washington Mutual and Fortis declined to comment. Lloyds TSB spokeswoman Kirsty Clay said none of the assets included in the available-for-sale reserves are considered to be ``permanently impaired.''

$100 Billion Hole

The writedowns aren't finished yet. London-based Fitch Ratings Ltd. expects as much as $110 billion in additional losses on subprime securities.

Declines in asset prices have spread beyond subprime though, affecting other mortgage bonds, securitized car and student loans, leveraged lending that backs private equity buyouts and credit derivatives. When all that is included, the IMF estimates that total losses from the U.S. subprime debacle will reach $1 trillion, of which $510 billion will be born by banks. That means some $130 billion in losses remains to be taken.

``The $100 billion hole between writedowns and capital raised so far needs to be filled,''[/b] said Michael Mayo, a New York-based analyst who tracks the financial-services industry at Deutsche Bank AG. ``If you don't fill that hole, with the 20-to-1 leverage existing on average out there, you need to de-lever $2 trillion of assets. You can do that or raise more capital.''

One way to increase capital has been to halt or slow down the pace of share buybacks. Companies often repurchase stock to offset dilution that occurs when shares are distributed to employees as part of their compensation.

Looking for Capital

Citigroup, the biggest U.S. bank by assets, JPMorgan Chase & Co., the third-largest bank, and Morgan Stanley, the No. 2 U.S. securities firm by market value, have suspended stock-buyback programs. All the companies are based in New York.

Outstanding stock increased 7 percent at Citigroup, 4.3 percent at Morgan Stanley, and 2 percent at JPMorgan during the past two quarters, according to regulatory filings. New York-based Lehman Brothers Holdings Inc., the fourth-biggest securities firm, has done the same without announcing a suspension of its repurchase program. Lehman shares in circulation rose 4.3 percent.

The first place banks and brokers went looking for capital was in the deep pockets of the Asian and Middle Eastern sovereign wealth funds, flush with cash from rising commodity prices. Then they reached out to public investors, who were offered hybrid securities with characteristics of both equity and debt, limiting their dilutive impact on common shares.

`It's Like Shampooing'

The sovereign funds, which bought shares at 20 percent above today's market prices, are probably not coming back soon, said Jeffrey Rosenberg, a New York-based managing director at Bank of America Corp., who was among the first analysts to warn clients about the mortgage crisis.

Banks can't keep selling hybrid bonds because ratings firms place limits on how much of their capital can be tied up in such securities. Rosenberg said the next round of equity-strengthening probably will be in the form of common stock.

``It's like shampooing: lather, rinse, repeat -- write down, raise capital, repeat,'' Rosenberg said. ``How long can they keep doing it? Shareholders are in for a long ride.''

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 113035

- Joined: Wed May 07, 2008 9:28 am

Re: Subprime Issues

23 May 2008 10:14 GMT

UBS CEO Rohner says future U.S. subprime writedowns smaller than in Q1

ZURICH (Thomson Financial) - UBS AG. does not expect further writedowns relating to its U.S. real estate market exposure of a similar size to those reported on April 1, 2008, chief executive Marcel Rohner said in an interview with Swiss finance bi-weekly Bilanz.

At the time, Switzerland's largest bank had disclosed a $19 billion writedown on U.S. real estate and related structured credit positions, resulting in a first quarter net loss of 11.535 billion Swiss francs.

With total subprime-related writedowns of $37.4 billion, UBS is currently the world's worst hit banks.

Rohner said that the size of future writedowns on its substantially reduced exposure will depend on various factors, such as the development of the U.S. real estate market and reserves it has built for monoline-insurers.

He also said that further sales of subprime positions are on the cards, similar to its deal with BlackRock Inc.

UBS on Wednesday completed the sale of securitized debt to BlackRock for $15 billion - but was forced to provide three quarters of the financing for the deal to go through.

UBS said the primarily subprime and Alt-A U.S. residential mortgage-backed securities are worth a nominal $22 billion, giving the global investment management firm a 32 percent discount on its face value.

UBS CEO Rohner says future U.S. subprime writedowns smaller than in Q1

ZURICH (Thomson Financial) - UBS AG. does not expect further writedowns relating to its U.S. real estate market exposure of a similar size to those reported on April 1, 2008, chief executive Marcel Rohner said in an interview with Swiss finance bi-weekly Bilanz.

At the time, Switzerland's largest bank had disclosed a $19 billion writedown on U.S. real estate and related structured credit positions, resulting in a first quarter net loss of 11.535 billion Swiss francs.

With total subprime-related writedowns of $37.4 billion, UBS is currently the world's worst hit banks.

Rohner said that the size of future writedowns on its substantially reduced exposure will depend on various factors, such as the development of the U.S. real estate market and reserves it has built for monoline-insurers.

He also said that further sales of subprime positions are on the cards, similar to its deal with BlackRock Inc.

UBS on Wednesday completed the sale of securitized debt to BlackRock for $15 billion - but was forced to provide three quarters of the financing for the deal to go through.

UBS said the primarily subprime and Alt-A U.S. residential mortgage-backed securities are worth a nominal $22 billion, giving the global investment management firm a 32 percent discount on its face value.

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: Subprime Issues

Refiled into this thread from the "Non-US Economic Data" thread.

From HengHeng with thanks:-

My comments : this are the people which might be needed to set the books for US's banks correct. At the very least they are trying to give value to those mortgates as compared to letting it have a spiral drop. I believe in time to come , the sub prime would be solved. Of course it might take time and alot of pain to those home owners but most of the reason why they can't pay up for their housing is due to the fact they max their paying ablities for buying a house.

Therefore , it is not that they aren't able to pay but just only that probably they can't afford to live at that level but they can always downgrade or rent. This creates another kind of demand.

----------------------------------------------------------------------------------------

May 15 (Bloomberg) -- The way out of the worst U.S. housing slump since the 1930s goes through Angel Gutierrez.

Gutierrez buys bad mortgages a dozen at a time for a fraction of their face value from lenders overwhelmed by the highest number of defaults in 23 years. When he goes door to door to negotiate lower payments for homeowners or pay them to move so he can sell the house, he's speeding up the recovery by establishing a price for the homes and flushing out the least reliable borrowers.

``You buy the mortgage for pennies on the dollar, carry the big stick, tell the homeowner how it's going to be, then double your money very easily,'' Gutierrez said.

Gutierrez and his wife Brenda, based in San Diego, are a two- person shop in an industry that is attracting deep-pocketed investors such as BlackRock Inc., which manages $1.36 trillion in assets. While Gutierrez said he can buy up to $300,000 of bad loans with his own money and has funding sources for about $1 million, New York-based BlackRock plans to raise $2 billion to invest in discount mortgages.

``At this stage of the game they're playing a very small role, but I expect that that role will accelerate as more people are willing to accept reality,'' said Sam Zell, the billionaire real estate investor who's called ``the grave dancer'' for buying distressed assets. ``The single-family market has to be cleared. No market works unless it clears. If banks can't clear, they can't make new loans. Anything you do to keep people who can't afford it in their houses is another way of delaying the market clearing.''

Eyeballing Properties

In San Diego's Encanto neighborhood, where median home prices slid 38 percent in March from a year earlier, according to La Jolla, California-based DataQuick Information Systems Inc., Gutierrez, 42, pulled up in front of an L-shaped, one-story stucco house. The grass was tall enough to hide a broken child's swing in the front yard. A dented Budweiser can lay next to the walkway.

Gutierrez, who was eyeballing the property to see if he wanted to bid on the mortgage, checked the gas meter mounted on the garage. It was spinning, a sign the home was probably occupied.

The homeowner was $365,000 under water after buying the house with no money down in June 2005, according to a spreadsheet listing about 30 loans for sale by a national mortgage servicer that Gutierrez referred to in his truck. If Gutierrez bought the note for 20 cents on the dollar, or $73,000, he could probably get the owner to leave by giving her $5,000 for moving expenses, then sell the home for about $150,000, well below even the neighborhood's declining market value, he said. That would leave him a profit of about $70,000.

`Buy Cheap, Sell Fast'

``I like the fast nickel,'' he said. ``You buy them cheap, you sell them fast and you get paid.''

Gutierrez said he didn't want to buy the house before he owned the mortgage because then he'd have to settle with the company that did own the note. That could be expensive. Negotiating a new mortgage for the homeowner could be tough, too, he said, because most of the lenders he used have gone out of business.

Still, when there was no answer at the front door, Gutierrez slipped a bright orange sheet of paper into the jamb. It gave the homeowner Gutierrez's phone number to call if he was interested in selling.

``That's so I can feel them out, see what they're thinking,'' Gutierrez said.

Gutierrez hailed a neighbor two doors down who was unloading groceries from her car. She explained that the woman who lived in the house was probably at work and her children were at school. The woman's husband and brother were both ``nowhere to be found,'' she said.

`Bottom Feeder'

``You hear all kinds of stories,'' Gutierrez said later.

Gutierrez said he'll probably offer the homeowner enough cash to pay for a mover and a couple of months in a rented apartment because, he said, many of them want to get out but don't have the money.

``I'm considered a bottom feeder,'' Gutierrez said. ``That's the way bankers see me. They only want the best loans, the loans that are paying. That's nice, but there's no money in it.''

Gutierrez has no shortage of defaulting borrowers close to home. One in every 74 homes, or 15,315, in the San Diego area was in the foreclosure process in the first three months of 2008, compared with one in every 194 homes nationally, according to RealtyTrac Inc. Foreclosure filings in the San Diego area rose 252 percent in the first quarter from a year earlier, compared with a 112 percent increase in the U.S., the Irvine, California-based real estate data provider said.

Unsold Homes

The number of unsold new homes on the national market is the highest since 1980, according to the U.S. Census Bureau. More homeowners are late on their monthly payments than at any time in the last 23 years, the Mortgage Bankers Association said.

The number of home loans for sale is rising, said Marshall Whalen, managing member of Stockbridge Capital LLC in Albany, New York, which bought 19 bad, or nonperforming, mortgages from the Federal Deposit Insurance Corp. in March for 38 cents on the dollar.

``We went from seeing a couple deals a quarter to now we're seeing 20 big deals a quarter,'' Whalen said. ``You really had to beat the bushes to find product before and now you don't have to do that.''

Gutierrez said smaller operators like him are getting ``knocked out of the game'' because of the volume of mortgages that banks want to dump. With Wall Street giants like New York- based BlackRock, Goldman Sachs Group Inc. and Morgan Stanley getting into the business by bidding on thousands of mortgages at a time, Gutierrez said it will be increasingly difficult for ``bottom feeders'' like himself to make a living.

Getting Squeezed

``The banks want to get rid of the loans, and they want to get rid of them to one company, not 20 or 30 companies,'' Gutierrez said. ``It makes sense. I would do the same thing.''

A nonperforming loan that went for 70 cents on the dollar two years ago will generally go for about 50 cents today, and 60 cents if payments are still being made, said Jeffrey Kirsch, chief executive officer of Miami-based American Residential Equities LLC, which trades and services mortgages.

Prices will ``jump dramatically when bigger players get in and start buying nonperforming loans,'' Kirsch said.

BlackRock, the biggest publicly traded U.S. asset manager, announced in March it was backing a new company called Private National Mortgage Acceptance Co. LLC, also known as PennyMac, that will buy mortgages at a discount and renegotiate borrowing terms with homeowners. The Calabasas, California-based company will then service the loans, meaning it will collect monthly payments.

Highfields Capital Management LP, a Boston hedge fund that manages about $10 billion, also has a stake in the new firm.

PennyMac

PennyMac is headed by Stanford Kurland, former president of Countrywide Financial Corp., the largest U.S. home lender and mortgage servicer. Kurland was the one-time heir apparent to Countrywide CEO Angelo Mozilo.

The new company will avoid foreclosing on borrowers, said Mark Suter, PennyMac's chief portfolio strategy officer. Aside from the social cost of foreclosure -- vacant homes are eyesores and magnets for vandals, and they can bring down home values in the area -- Suter said it was more expensive to take over ownership of a home than it was to get a borrower to start paying the mortgage again.

``We don't want to provide a Band-Aid that will fall off,'' Suter said in an interview. ``We want to create permanent solutions to borrowers to stay in their homes.''

Foreclosure Costs

Foreclosure can cost lenders 35 percent of the value of the home, according to a study by the Association of Community Organizations for Reform Now, or ACORN, a non-profit homeowner advocacy group.

``Banks don't want to hold on to a nonperforming asset for the length of time it takes to get people out of the house,'' said Morris Davis, a real estate professor at the University of Wisconsin in Madison.

Lenders also sell loans so they can avoid the hassle of dealing with problematic borrowers, said Eric Fitzwater, senior analyst with SNL Financial LC in Charlottesville, Virginia.

``There are horror stories of people getting kicked out of their houses and because they were pissed off, totally destroying the house,'' Fitzwater said. ``Getting 60 cents on the dollar is better than getting nothing.''

On a sunny day last month, Gutierrez knocked on doors in Imperial Beach, an arid, hilly town just south of San Diego. There were three Imperial Beach houses on the spreadsheet provided by the mortgage servicer that was selling them; none of the borrowers had made a payment in months. Gutierrez was ``driving'' the neighborhood, as he calls it, to determine what he would bid on the pool.

Imperial Beach

In Imperial Beach, 15 homeowners lost their properties to foreclosure in the first three months of 2008, compared with four in the same period last year, according to DataQuick. The town's population is about 26,000, according to the U.S. Census Bureau. The median single-family resale price in town fell 19 percent in the first quarter compared with a year earlier, DataQuick said.

Gutierrez said that because of the legal fees, he avoids foreclosing except when he has to ``clean'' the title of liens or other legal judgments. He said he never collects borrowers' monthly payments because he doesn't want his life to get too ``complicated.''

At a one-story, L-shaped stucco house in Imperial Beach with four-foot-tall rose bushes and an American flag hanging from the garage, 62-year-old Armida Leos answered the door. Her 73-year-old husband, Gilberto, a former U.S. Border Patrol officer, had to quit retirement and get a job as a security guard when their monthly mortgage payments jumped to $3,200 from $2,400, she said.

`We're Losing It'

``I feel really bad for my husband because he worked his heart out to get us into this house and now we're losing it,'' Leos said.

Gutierrez's spreadsheet said the Leos family owed $455,000 on their mortgage. Leos said she and her husband spent $50,000 fixing up the house when they moved in three years ago. They had just received notice from San Diego County that their property tax was being reduced because the house had been assessed for $193,000.

Back in his pickup truck, Gutierrez said he was prepared to offer Leos and her husband $5,000 to move out. He made note of the town's falling home prices and how the house didn't seem to be that big.

``That's not a real selling point,'' he said.

From HengHeng with thanks:-

My comments : this are the people which might be needed to set the books for US's banks correct. At the very least they are trying to give value to those mortgates as compared to letting it have a spiral drop. I believe in time to come , the sub prime would be solved. Of course it might take time and alot of pain to those home owners but most of the reason why they can't pay up for their housing is due to the fact they max their paying ablities for buying a house.

Therefore , it is not that they aren't able to pay but just only that probably they can't afford to live at that level but they can always downgrade or rent. This creates another kind of demand.

----------------------------------------------------------------------------------------

May 15 (Bloomberg) -- The way out of the worst U.S. housing slump since the 1930s goes through Angel Gutierrez.

Gutierrez buys bad mortgages a dozen at a time for a fraction of their face value from lenders overwhelmed by the highest number of defaults in 23 years. When he goes door to door to negotiate lower payments for homeowners or pay them to move so he can sell the house, he's speeding up the recovery by establishing a price for the homes and flushing out the least reliable borrowers.

``You buy the mortgage for pennies on the dollar, carry the big stick, tell the homeowner how it's going to be, then double your money very easily,'' Gutierrez said.

Gutierrez and his wife Brenda, based in San Diego, are a two- person shop in an industry that is attracting deep-pocketed investors such as BlackRock Inc., which manages $1.36 trillion in assets. While Gutierrez said he can buy up to $300,000 of bad loans with his own money and has funding sources for about $1 million, New York-based BlackRock plans to raise $2 billion to invest in discount mortgages.

``At this stage of the game they're playing a very small role, but I expect that that role will accelerate as more people are willing to accept reality,'' said Sam Zell, the billionaire real estate investor who's called ``the grave dancer'' for buying distressed assets. ``The single-family market has to be cleared. No market works unless it clears. If banks can't clear, they can't make new loans. Anything you do to keep people who can't afford it in their houses is another way of delaying the market clearing.''

Eyeballing Properties

In San Diego's Encanto neighborhood, where median home prices slid 38 percent in March from a year earlier, according to La Jolla, California-based DataQuick Information Systems Inc., Gutierrez, 42, pulled up in front of an L-shaped, one-story stucco house. The grass was tall enough to hide a broken child's swing in the front yard. A dented Budweiser can lay next to the walkway.

Gutierrez, who was eyeballing the property to see if he wanted to bid on the mortgage, checked the gas meter mounted on the garage. It was spinning, a sign the home was probably occupied.

The homeowner was $365,000 under water after buying the house with no money down in June 2005, according to a spreadsheet listing about 30 loans for sale by a national mortgage servicer that Gutierrez referred to in his truck. If Gutierrez bought the note for 20 cents on the dollar, or $73,000, he could probably get the owner to leave by giving her $5,000 for moving expenses, then sell the home for about $150,000, well below even the neighborhood's declining market value, he said. That would leave him a profit of about $70,000.

`Buy Cheap, Sell Fast'

``I like the fast nickel,'' he said. ``You buy them cheap, you sell them fast and you get paid.''

Gutierrez said he didn't want to buy the house before he owned the mortgage because then he'd have to settle with the company that did own the note. That could be expensive. Negotiating a new mortgage for the homeowner could be tough, too, he said, because most of the lenders he used have gone out of business.

Still, when there was no answer at the front door, Gutierrez slipped a bright orange sheet of paper into the jamb. It gave the homeowner Gutierrez's phone number to call if he was interested in selling.

``That's so I can feel them out, see what they're thinking,'' Gutierrez said.

Gutierrez hailed a neighbor two doors down who was unloading groceries from her car. She explained that the woman who lived in the house was probably at work and her children were at school. The woman's husband and brother were both ``nowhere to be found,'' she said.

`Bottom Feeder'

``You hear all kinds of stories,'' Gutierrez said later.

Gutierrez said he'll probably offer the homeowner enough cash to pay for a mover and a couple of months in a rented apartment because, he said, many of them want to get out but don't have the money.

``I'm considered a bottom feeder,'' Gutierrez said. ``That's the way bankers see me. They only want the best loans, the loans that are paying. That's nice, but there's no money in it.''

Gutierrez has no shortage of defaulting borrowers close to home. One in every 74 homes, or 15,315, in the San Diego area was in the foreclosure process in the first three months of 2008, compared with one in every 194 homes nationally, according to RealtyTrac Inc. Foreclosure filings in the San Diego area rose 252 percent in the first quarter from a year earlier, compared with a 112 percent increase in the U.S., the Irvine, California-based real estate data provider said.

Unsold Homes

The number of unsold new homes on the national market is the highest since 1980, according to the U.S. Census Bureau. More homeowners are late on their monthly payments than at any time in the last 23 years, the Mortgage Bankers Association said.

The number of home loans for sale is rising, said Marshall Whalen, managing member of Stockbridge Capital LLC in Albany, New York, which bought 19 bad, or nonperforming, mortgages from the Federal Deposit Insurance Corp. in March for 38 cents on the dollar.

``We went from seeing a couple deals a quarter to now we're seeing 20 big deals a quarter,'' Whalen said. ``You really had to beat the bushes to find product before and now you don't have to do that.''

Gutierrez said smaller operators like him are getting ``knocked out of the game'' because of the volume of mortgages that banks want to dump. With Wall Street giants like New York- based BlackRock, Goldman Sachs Group Inc. and Morgan Stanley getting into the business by bidding on thousands of mortgages at a time, Gutierrez said it will be increasingly difficult for ``bottom feeders'' like himself to make a living.

Getting Squeezed

``The banks want to get rid of the loans, and they want to get rid of them to one company, not 20 or 30 companies,'' Gutierrez said. ``It makes sense. I would do the same thing.''

A nonperforming loan that went for 70 cents on the dollar two years ago will generally go for about 50 cents today, and 60 cents if payments are still being made, said Jeffrey Kirsch, chief executive officer of Miami-based American Residential Equities LLC, which trades and services mortgages.

Prices will ``jump dramatically when bigger players get in and start buying nonperforming loans,'' Kirsch said.

BlackRock, the biggest publicly traded U.S. asset manager, announced in March it was backing a new company called Private National Mortgage Acceptance Co. LLC, also known as PennyMac, that will buy mortgages at a discount and renegotiate borrowing terms with homeowners. The Calabasas, California-based company will then service the loans, meaning it will collect monthly payments.

Highfields Capital Management LP, a Boston hedge fund that manages about $10 billion, also has a stake in the new firm.

PennyMac

PennyMac is headed by Stanford Kurland, former president of Countrywide Financial Corp., the largest U.S. home lender and mortgage servicer. Kurland was the one-time heir apparent to Countrywide CEO Angelo Mozilo.

The new company will avoid foreclosing on borrowers, said Mark Suter, PennyMac's chief portfolio strategy officer. Aside from the social cost of foreclosure -- vacant homes are eyesores and magnets for vandals, and they can bring down home values in the area -- Suter said it was more expensive to take over ownership of a home than it was to get a borrower to start paying the mortgage again.

``We don't want to provide a Band-Aid that will fall off,'' Suter said in an interview. ``We want to create permanent solutions to borrowers to stay in their homes.''

Foreclosure Costs

Foreclosure can cost lenders 35 percent of the value of the home, according to a study by the Association of Community Organizations for Reform Now, or ACORN, a non-profit homeowner advocacy group.

``Banks don't want to hold on to a nonperforming asset for the length of time it takes to get people out of the house,'' said Morris Davis, a real estate professor at the University of Wisconsin in Madison.

Lenders also sell loans so they can avoid the hassle of dealing with problematic borrowers, said Eric Fitzwater, senior analyst with SNL Financial LC in Charlottesville, Virginia.

``There are horror stories of people getting kicked out of their houses and because they were pissed off, totally destroying the house,'' Fitzwater said. ``Getting 60 cents on the dollar is better than getting nothing.''

On a sunny day last month, Gutierrez knocked on doors in Imperial Beach, an arid, hilly town just south of San Diego. There were three Imperial Beach houses on the spreadsheet provided by the mortgage servicer that was selling them; none of the borrowers had made a payment in months. Gutierrez was ``driving'' the neighborhood, as he calls it, to determine what he would bid on the pool.

Imperial Beach

In Imperial Beach, 15 homeowners lost their properties to foreclosure in the first three months of 2008, compared with four in the same period last year, according to DataQuick. The town's population is about 26,000, according to the U.S. Census Bureau. The median single-family resale price in town fell 19 percent in the first quarter compared with a year earlier, DataQuick said.

Gutierrez said that because of the legal fees, he avoids foreclosing except when he has to ``clean'' the title of liens or other legal judgments. He said he never collects borrowers' monthly payments because he doesn't want his life to get too ``complicated.''

At a one-story, L-shaped stucco house in Imperial Beach with four-foot-tall rose bushes and an American flag hanging from the garage, 62-year-old Armida Leos answered the door. Her 73-year-old husband, Gilberto, a former U.S. Border Patrol officer, had to quit retirement and get a job as a security guard when their monthly mortgage payments jumped to $3,200 from $2,400, she said.

`We're Losing It'

``I feel really bad for my husband because he worked his heart out to get us into this house and now we're losing it,'' Leos said.

Gutierrez's spreadsheet said the Leos family owed $455,000 on their mortgage. Leos said she and her husband spent $50,000 fixing up the house when they moved in three years ago. They had just received notice from San Diego County that their property tax was being reduced because the house had been assessed for $193,000.

Back in his pickup truck, Gutierrez said he was prepared to offer Leos and her husband $5,000 to move out. He made note of the town's falling home prices and how the house didn't seem to be that big.

``That's not a real selling point,'' he said.

It's all about "how much you made when you were right" & "how little you lost when you were wrong"

-

winston - Billionaire Boss

- Posts: 113035

- Joined: Wed May 07, 2008 9:28 am

Re: Subprime Issues

what i have been reading about defaulters of mortgage loans are the ones who cannot afford the reset rates...that is after 2 years or so, depending on their loan plan, the banks start to signifcantly increase their mortgage repayment interest rate...

these defaulters kau peh kau boo...say they wont informed earlier...or not enough info was given to them before they signed up the loans....or so they say...

banks were investigated by regulators for "cheating" clients...etc...

but whatever the reasons....it appears now that ~< 5% of total population (my mental accumulation from all the reads) are suffering from this mortgage loan problem now...

these defaulters kau peh kau boo...say they wont informed earlier...or not enough info was given to them before they signed up the loans....or so they say...

banks were investigated by regulators for "cheating" clients...etc...

but whatever the reasons....it appears now that ~< 5% of total population (my mental accumulation from all the reads) are suffering from this mortgage loan problem now...

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Re: Subprime Issues

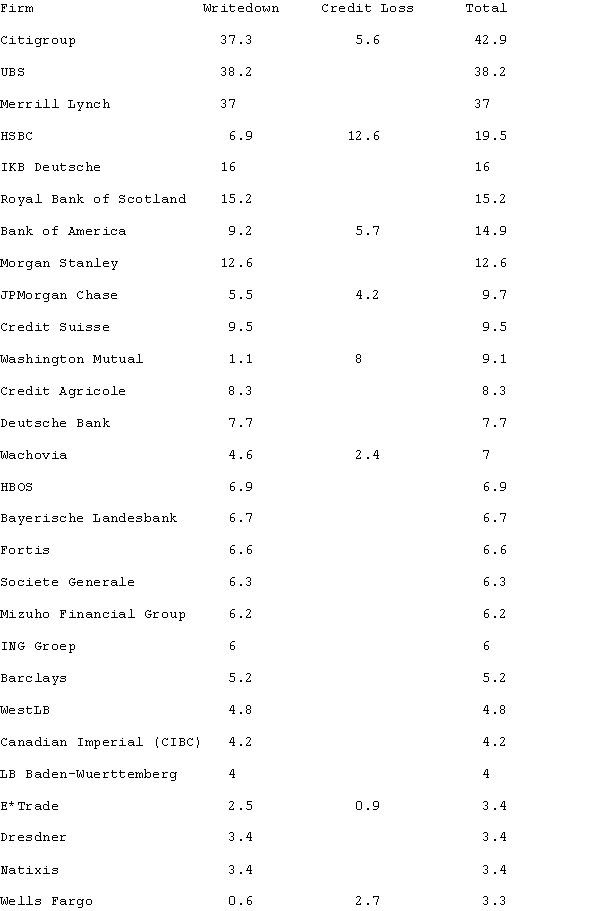

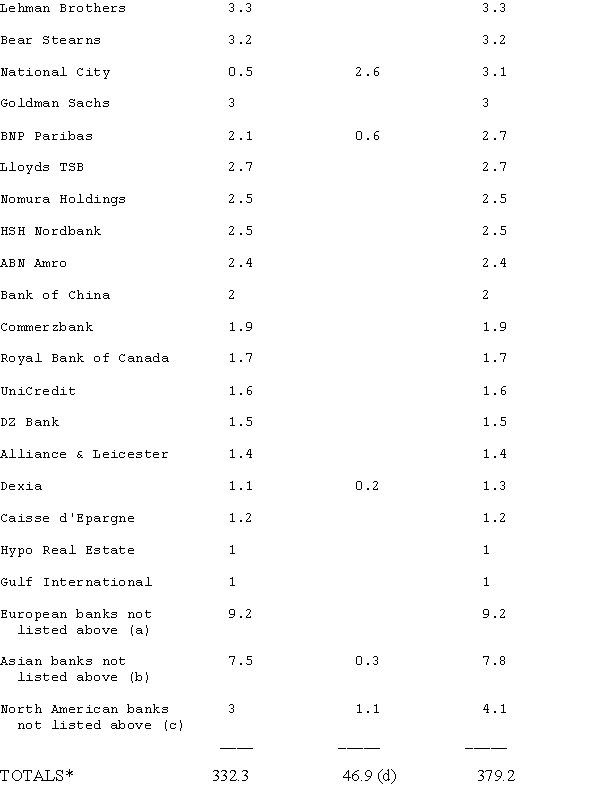

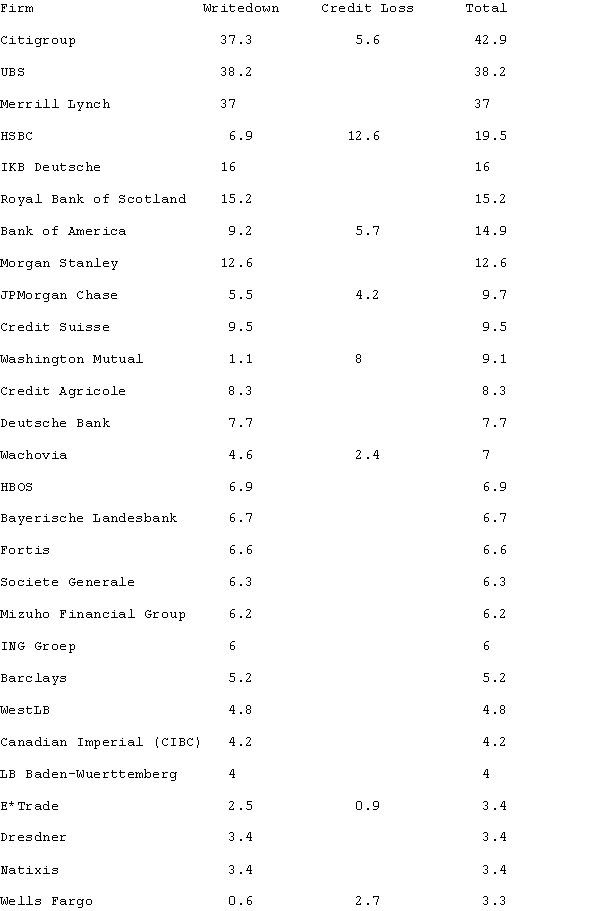

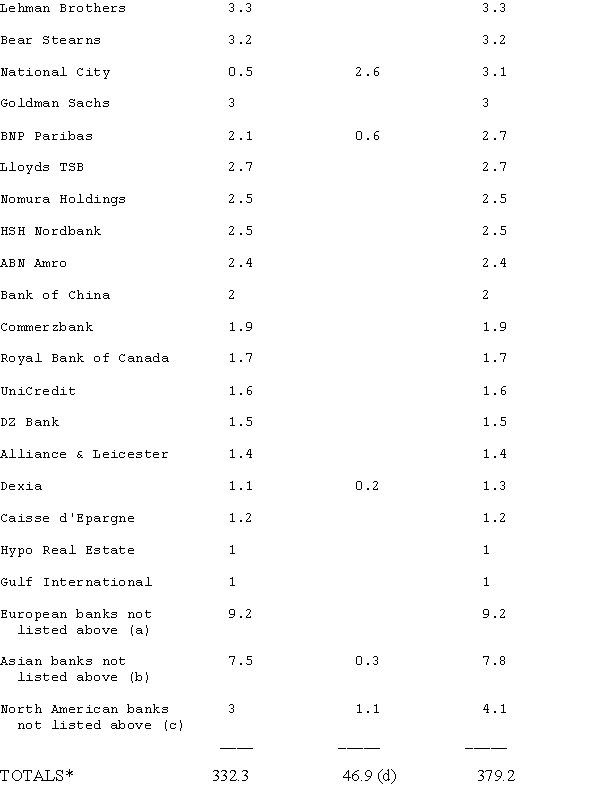

Subprime Losses Top $379 Billion on Balance-Sheet Marks: Table

May 19 (Bloomberg) -- The following table shows the $379 billion in asset writedowns and credit losses since the beginning of 2007, including reserves set aside for bad loans, at more than 100 of the world's biggest banks and securities firms.

The writedown column now includes asset-value reductions that some banks list on their balance sheets rather than booking the losses against earnings. Regulatory filings show $35 billion of such balance-sheet writedowns at 20 banks.

All the charges stem from the collapse of the U.S. subprime- mortgage market. The figures, from company statements and filings, also reflect some credit losses or writedowns of mortgage assets that aren't subprime, as well as charges taken on leveraged-loan commitments.

All numbers are in billions of U.S. dollars, converted at today's exchange rate if reported in another currency. They are net of financial hedges the firms used to mitigate losses.

* Totals reflect figures before rounding. Some company names have

been abbreviated for space.

(a) European banks whose losses are less than $1 billion each are in this group: Allied Irish Banks, Bradford & Bingley, Aareal Bank, Deutsche Postbank, Standard Chartered, Northern Rock, NordLB, Rabobank, HVB Group, Sachsen LB, Intesa Sanpaolo, Landesbank Hessen-Thueringen, SEB AB, Erste Bank, DnB NOR, Anglo Irish, KBC Group, LB Berlin, NIBC Holding.

(b) Asian banks with writedowns of less than $1 billion: Mitsubishi UFJ, Shinsei, Sumitomo Trust, Aozora Bank, DBS Group, Australia & New Zealand Banking Group, Abu Dhabi Commercial, Bank Hapoalim, Arab Banking Corp., Fubon Financial, Industrial & Commercial Bank of China, Citic International, BOC Hong Kong, Bank of East Asia, China Construction Bank, Sumitomo Mitsui, ICICI Bank, State Bank of India, United Overseas, Wing Lung.

(c) North American banks included in this group: Bank of Montreal, National Bank of Canada, Bank of Nova Scotia, BB&T Corp., PNC Financial Services Group, SunTrust Banks, South Financial Group, Sovereign Bancorp, First Horizon.

(d) The difference between writedown and credit loss: Investment banks and the investment-banking units of financial conglomerates mark their assets to market values, whether they're loans, securities or collateralized debt obligations, and label that a ``writedown'' when values decline. Commercial banks take charge- offs on loans that have defaulted and increase reserves for loans they expect to go bad, which they label ``credit losses.'' Commercial banks can have writedowns on holdings of bonds or CDOs as well.

May 19 (Bloomberg) -- The following table shows the $379 billion in asset writedowns and credit losses since the beginning of 2007, including reserves set aside for bad loans, at more than 100 of the world's biggest banks and securities firms.

The writedown column now includes asset-value reductions that some banks list on their balance sheets rather than booking the losses against earnings. Regulatory filings show $35 billion of such balance-sheet writedowns at 20 banks.

All the charges stem from the collapse of the U.S. subprime- mortgage market. The figures, from company statements and filings, also reflect some credit losses or writedowns of mortgage assets that aren't subprime, as well as charges taken on leveraged-loan commitments.

All numbers are in billions of U.S. dollars, converted at today's exchange rate if reported in another currency. They are net of financial hedges the firms used to mitigate losses.

* Totals reflect figures before rounding. Some company names have

been abbreviated for space.

(a) European banks whose losses are less than $1 billion each are in this group: Allied Irish Banks, Bradford & Bingley, Aareal Bank, Deutsche Postbank, Standard Chartered, Northern Rock, NordLB, Rabobank, HVB Group, Sachsen LB, Intesa Sanpaolo, Landesbank Hessen-Thueringen, SEB AB, Erste Bank, DnB NOR, Anglo Irish, KBC Group, LB Berlin, NIBC Holding.

(b) Asian banks with writedowns of less than $1 billion: Mitsubishi UFJ, Shinsei, Sumitomo Trust, Aozora Bank, DBS Group, Australia & New Zealand Banking Group, Abu Dhabi Commercial, Bank Hapoalim, Arab Banking Corp., Fubon Financial, Industrial & Commercial Bank of China, Citic International, BOC Hong Kong, Bank of East Asia, China Construction Bank, Sumitomo Mitsui, ICICI Bank, State Bank of India, United Overseas, Wing Lung.

(c) North American banks included in this group: Bank of Montreal, National Bank of Canada, Bank of Nova Scotia, BB&T Corp., PNC Financial Services Group, SunTrust Banks, South Financial Group, Sovereign Bancorp, First Horizon.

(d) The difference between writedown and credit loss: Investment banks and the investment-banking units of financial conglomerates mark their assets to market values, whether they're loans, securities or collateralized debt obligations, and label that a ``writedown'' when values decline. Commercial banks take charge- offs on loans that have defaulted and increase reserves for loans they expect to go bad, which they label ``credit losses.'' Commercial banks can have writedowns on holdings of bonds or CDOs as well.

Options Strategies & Discussions  .(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah).

.(Trading Discipline : The Science of Constantly Acting on Knowledge Consistently - kennynah). Investment Strategies & Ideas

Investment Strategies & Ideas

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

..................................................................<A fool gives full vent to his anger, but a wise man keeps himself under control-Proverbs 29:11>.................................................................

-

kennynah - Lord of the Lew Lian

- Posts: 14201

- Joined: Wed May 07, 2008 2:00 am

- Location: everywhere.. and nowhere..

Return to AMERICAS & EUROPE: Data, News & Commentaries

Who is online

Users browsing this forum: No registered users and 2 guests