Page 1 of 23

Venture

Posted:

Fri May 09, 2008 9:26 pmby winston

Substantial shareholder Aberdeen Asset Management Asia Ltd has increased its deemed interest in Venture Corporation Ltd from 10.008% to 16.0182%.

Re: Venture

Posted:

Wed Jun 11, 2008 2:33 pmby iam802

ACQUISITION OF REMAINING 40% INTEREST IN SUBSIDIARY

http://info.sgx.com/webcorannc.nsf/37e9 ... enDocument====

Re: Venture

Posted:

Wed Jun 25, 2008 12:22 pmby winston

Franklin Resources, Inc. reduced its stake in Venture Corporation Limited from 11.95% to 10.95%.

Re: Venture

Posted:

Thu Jun 26, 2008 9:04 pmby iam802

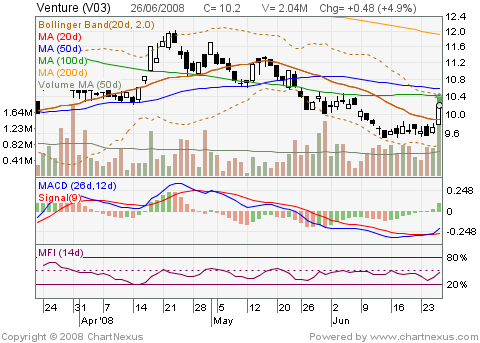

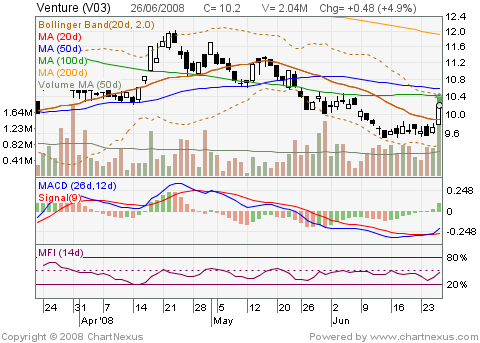

Seems like more pple (BB?) buying into Venture

Re: Venture

Posted:

Wed Aug 06, 2008 9:51 pmby winston

Not vested.

Venture profit down 17%

SINGAPORE - Contract electronics firm Venture Corp posted a 17 per cent fall in quarterly earnings on Wednesday, hit by a stronger Singapore dollar and as some customers delayed orders on worries over the global economic outlook.

Venture, Singapore's second-largest contract electronics maker after Nasdaq-listed Flextronics International, earned $65.6 million (US$47.5 million) for the April-June quarter, compared with $78.7 million in the same period a year ago.

The results were below a mean net profit estimate of $78.6 million from three analysts polled by Reuters.

Venture makes printers for Hewlett-Packard Co , the world's largest computer and printer maker, which accounts for about a quarter of the Singapore's company's sales.

It also produces hard drives for computer storage firm Iomega Corp and networking devices for electronics and testing equipment maker Agilent Technologies .

Venture shares fell 6.9 per cent in April-June, compared with a flat performance in rival Flextronics stock and a 14 per cent decline in shares of Taiwan's Hon Hai Precision Industry Co.

-- REUTERS

Re: Venture

Posted:

Thu Aug 07, 2008 12:41 pmby winston

Not vested.

Singapore Hot Stocks-Venture Corp down on OCBC downgrade

SINGAPORE, Aug 7 (Reuters) - Contract electronics firm Venture Corp dropped as much as 6.6 percent to hit a two-week low after it posted a 17 percent fall in quarterly earnings and OCBC downgraded it to "hold" from "buy".

Shares of Venture fell to a low of S$10.20.

OCBC analyst Carey Wong lowered Venture's price target to S$11.21 from S$12.84, citing the volatile U.S. dollar and a weakening macroeconomic picture.

The firm posted a dip in net profits to S$65.6 million for the April-June quarter due to a stronger Singapore dollar and some customer delay orders.

Re: Venture

Posted:

Mon Oct 27, 2008 4:12 pmby millionairemind

Venture Corporation

Franklin Resources Inc unloaded more shares of electronics manufacturing, engineering, customisation and logistic services provider Venture Corporation at a sharply lower price, with three million shares sold last Monday at an estimated price of $4.98 each. The trade reduced its deemed holdings by 12 per cent - to 21.6 million shares or 7.9 per cent.

The group previously sold 13.6 million shares from April 4 to Aug 22 at estimated prices of $10.46 to $9.70 each. Overall, the fund manager has reduced its stake by nearly 17 million shares or 44 per cent since April. The group had acquired a net 11 million shares from September 2005 to October 2007 at estimated prices of $10.00 to $14.80 each. Franklin Resources became a substantial shareholder in September 2005 after it acquired an initial 27.2 million shares or 10.1 per cent via off-market trade at $14.83 each. The stock closed at $4.42 on Friday.

Re: Venture

Posted:

Fri Nov 07, 2008 6:04 pmby millionairemind

November 7, 2008, 5.34 pm (Singapore time)

Venture Q3 net falls 47%

SINGAPORE - Venture Corp Ltd on Friday reported net profits for the third quarter ended September 30 fell 47.4 per cent to S$40.1 million, down from S$76.3 million year ago.

The company said its net profit included a fair value market adjustment on its derivative financial instruments amounting to a loss of S$29.8 million.

It said global outlook remains 'challenging with no discernible sign of immediate recovery'. -- REUTERS

Re: Venture

Posted:

Thu Nov 27, 2008 10:16 amby iam802

From DBS:

A rewarding venture

Story: Venture hit a ten-year low of S$3.90 recently on continuous liquidation prior to its removal from the MSCIIndex. With the stock down 70% year-to-date and the final round of index-linked selling over, we believe now is a good time to start accumulating Venture on the cheap.

Point: In revisiting our assumptions, we have slashed FY08 earnings by 33% to fully provide for the remaining S$90m CDO given worsening credit spread in October. We have also trimmed FY09 earnings to reflect conservative demand outlook, which we believe could potentially pressure FY09/10 revenue growth although Venture should hold up margins better relative to peers with its higher value-added ODM services.

Relevance: In spite of our steep earnings cut, Venture looks oversold at an all time low of 5.7x FY09 earningsand 0.6x P/BV. This implies that market has priced in a lot of negatives including the entire CDO write-off plus a worst-case scenario of massive write-downs for DMX and goodwill from the purchase of GES (see scenario valuations). However, we think a total write-off is unlikely because 1) management continues to perceive DMX as a long-term strategic investment, and 2) GES is still benefiting the company with stronger customer relationships and cross-selling opportunities. Our base case FY09 forecast encompassed complete write down of CDO and 10% amortization of intangibles over a ten-year period. Valuation aside, Venture is highly FCF generative (c. S$150-200m/ yr) and can therefore comfortably pay off debts (S$8m net debt at end 3Q08), and still sustain dividend payment of S$0.50/shr, translating to a solid 12% dividend yield, amid falling profits. With our revised assumption, we now see fair value at S$6.40, still pegged to 9x FY09 P/E. Upgrade to Buy.

Re: Venture

Posted:

Wed Dec 03, 2008 4:04 pmby millionairemind

Anybody looking at Venture??

Very nice support line at $4