Saw this posting on SGX and did a check on its Financial Ratios. Maybe it is worth a second look.

1. The Company

http://finance.google.com/finance?q=SIN%3AD1R

Key points:

- fund managers

- manage both public-listed REITS and private real estate funds

- also manage real estate fund

In a way, it is like 'Babcock' but with focus on real estate. (I may be wrong here)

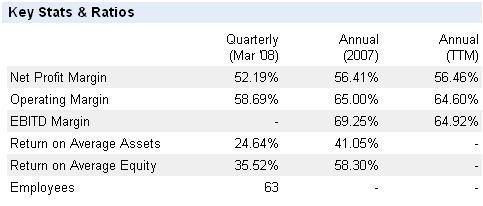

2. Financial Ratios:

3. The announcement at SGX

http://info.sgx.com/webcorannc.nsf/ef3b ... enDocument

====

ARA MARKET UPDATE - ARA COMPLETES THIRD AND FINAL CLOSING OF FLAGSHIP ARA ASIA DRAGON FUND WITH COMMITMENTS AND CO-INVESTMENT ALLOCATIONS OF OVER US$1.6 BILLION

==

Key points from document:

- this is their flagship fund (in real estate)

- Fund has more than US$1.6biillion at its disposal; representing real estate capacity investment capacity of over US$5 billion

- Primary focus : China, SG, HK, MY

- Seconday focus: Taiwan, Thailand, Vietnam and other rapidly growing economies in the region.

- Fund's investors include public pension funds, foundations, and other global institutional investors seeking diversification in Asia's real estate

- To date, the fund has invested in real estate with value exceeding US$800m

===

So, shooting off my mind.

Good time for them to be looking at real estate. I would think that the US subprime stuffs should have an impact on borrowings. They could easily be in a good position to pick and finance some pretty good properties. Also, when the dust settles on all the US subprime, oil issues, there is a high chance that Asia will resume its growth. Asia's real estate is likely to grow faster than that of US and Europe.

I am just thinking this could be a stock or company that is suitable for holding 3-5 years term?

To me , it seems that expenses are fairly kept under controlled. But, the potential for greater return is there.

One part of fund managers revenue or earnings are based on 'performance' which should act as great motivation factors.

ARA is also very focused in real estate only. And I think this reduce complexity when compare to Babcock (not saying that there is anything wrong with Babcock).

But, I think real estate business is always something that retail investors can understand easier compared to Babcock's structured investments or alternative investments.

Just some random thoughts late at night.

===

EDIT: June 24 - put in screen capture of financial ratios for better display.