Investment Myth Busted8. There is a PE where the stock will not go any lower. FA is the only way to invest. Cheap stocks do get cheaper. (Nothing against FA here but it does not tell you about mkt sentiments)

Newly added - There is a PE where the stock will not go any higherFirst and foremost, I am a FA practitioner at heart. I won't invest/trade a stock before I have time to go thro' their balance sheet and do a reasonable estimate of their growth.

But then hor, I am also a CANSLIM practitioner. That is where my TA part Mr. Hyde comes in. In my view, we can do all the FA we want, BUT THE MKT ALWAYS KNOWS BETTER...

A simple question. If a stock you are looking at has a PE ratio of 6 and growing at a reasonable 10-15% a year, with low debts, would you buy it??? Sure, most FA will say... Remember, the value of a company is what the market prices it at... Here is a chart of China HongCheng. (Stock data info taken from SI)

If you have bought it at a PE ratio of 6 around 50cts... you would have lost 60% OF YOURE INVESTMENTS BY NOW!!! Would you buy more at say 50cts?? How about 40cts?? 30cts??? It is now 20cts and change. It has a PE ratio of around 3 now. And the SAD news is that this is NOT A MONEY LOSING COMPANY!

The 9months earnings so far is up about 25% YOY. The earnings is of course decelerating but not the company is not making a loss... that is what I mean by the market always knows better and without institutional support, the stock will not move.

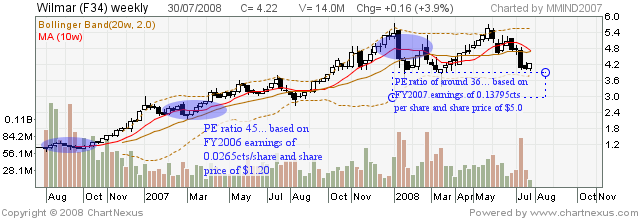

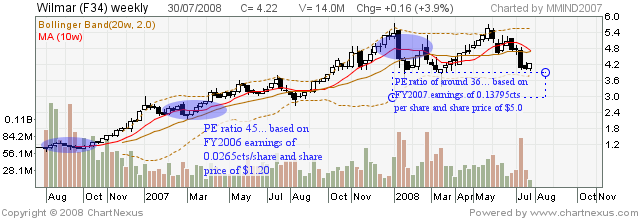

http://info.sgx.com/webcoranncatth.nsf/ ... penelementCompare this to Wilmar... When it burst on the scene 2 years ago, it was trading at $1.0.. At its peak, it was $5.. now it is around $4.20... When it was trading at $2.4, it has a trailing PE of 45...

Yes, we can argue till our face is red that we are comparing apples to oranges...

Remember, without institutional support, the stocks in your basket CANNOT MOVE!!! Who is going to buy from you to push it higher???

It has always been supply and demand that determine the stock prices.. The value of your company depends on the price the last seller is willing to sell at. If he is not willing to let go and there is enough demand, the price rises.. simple economics.

Of course we can say that mkt can be depressed... if that is the case, Y only China HongCheng and not Wilmar?? China HongCheng does not have any institutional support, plain and simple.. that is the reason Y it keeps drifting down, just due to sheer gravity..

Maybe my examples here are not good enough to illustrate my points on the futility of just using FA alone.

I am very sure you are aware of tons of drifting stocks on SGX that keeps getting lower and lower....

My examples are just to illustrate on the fallacy of buying cheap stocks with the thinking that it cannot go any lower or shunning expensive stocks thinking that it cannot go any higher.

Just be careful out there... supply and demand always determine the value of your company.

.